We Ran A Stock Scan For Earnings Growth And V.S.T. Tillers Tractors (NSE:VSTTILLERS) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like V.S.T. Tillers Tractors (NSE:VSTTILLERS), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for V.S.T. Tillers Tractors

How Quickly Is V.S.T. Tillers Tractors Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. V.S.T. Tillers Tractors managed to grow EPS by 10% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

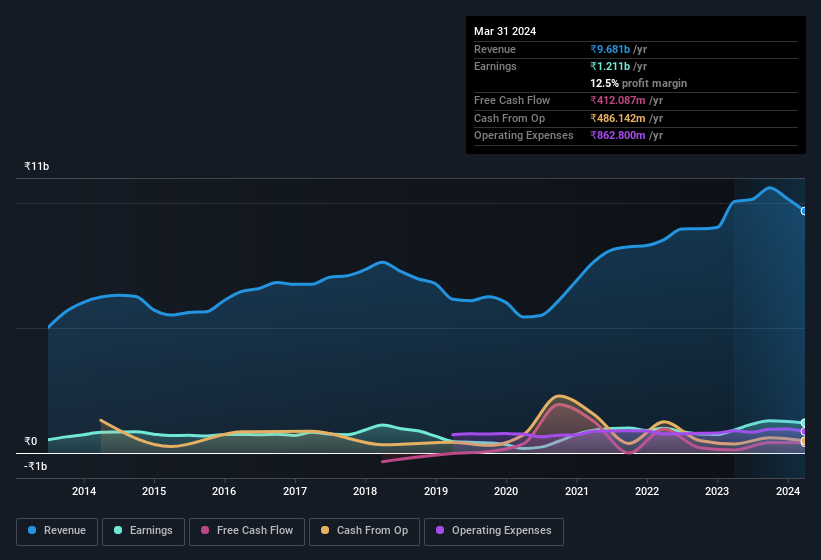

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. V.S.T. Tillers Tractors' EBIT margins are flat but, worryingly, its revenue is actually down. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for V.S.T. Tillers Tractors?

Are V.S.T. Tillers Tractors Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that V.S.T. Tillers Tractors insiders own a meaningful share of the business. Owning 43% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at ₹13b at the current share price. So there's plenty there to keep them focused!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to V.S.T. Tillers Tractors, with market caps between ₹17b and ₹67b, is around ₹24m.

V.S.T. Tillers Tractors offered total compensation worth ₹17m to its CEO in the year to March 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does V.S.T. Tillers Tractors Deserve A Spot On Your Watchlist?

As previously touched on, V.S.T. Tillers Tractors is a growing business, which is encouraging. The growth of EPS may be the eye-catching headline for V.S.T. Tillers Tractors, but there's more to bring joy for shareholders. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. It is worth noting though that we have found 2 warning signs for V.S.T. Tillers Tractors that you need to take into consideration.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VSTTILLERS

V.S.T. Tillers Tractors

Manufactures and trades agricultural machinery in India and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives