Over the last week, India's market has shown stability with no significant changes, while it has experienced a robust growth of 41% over the past year. With earnings projected to grow by 17% annually in the coming years, dividend stocks continue to be an attractive option for investors looking for steady income in a flourishing market environment.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Bhansali Engineering Polymers (BSE:500052) | 4.12% | ★★★★★★ |

| Castrol India (BSE:500870) | 3.96% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.89% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.04% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.65% | ★★★★★☆ |

| Balmer Lawrie Investments (BSE:532485) | 4.03% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.83% | ★★★★★☆ |

| Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.54% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.54% | ★★★★★☆ |

| Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.64% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

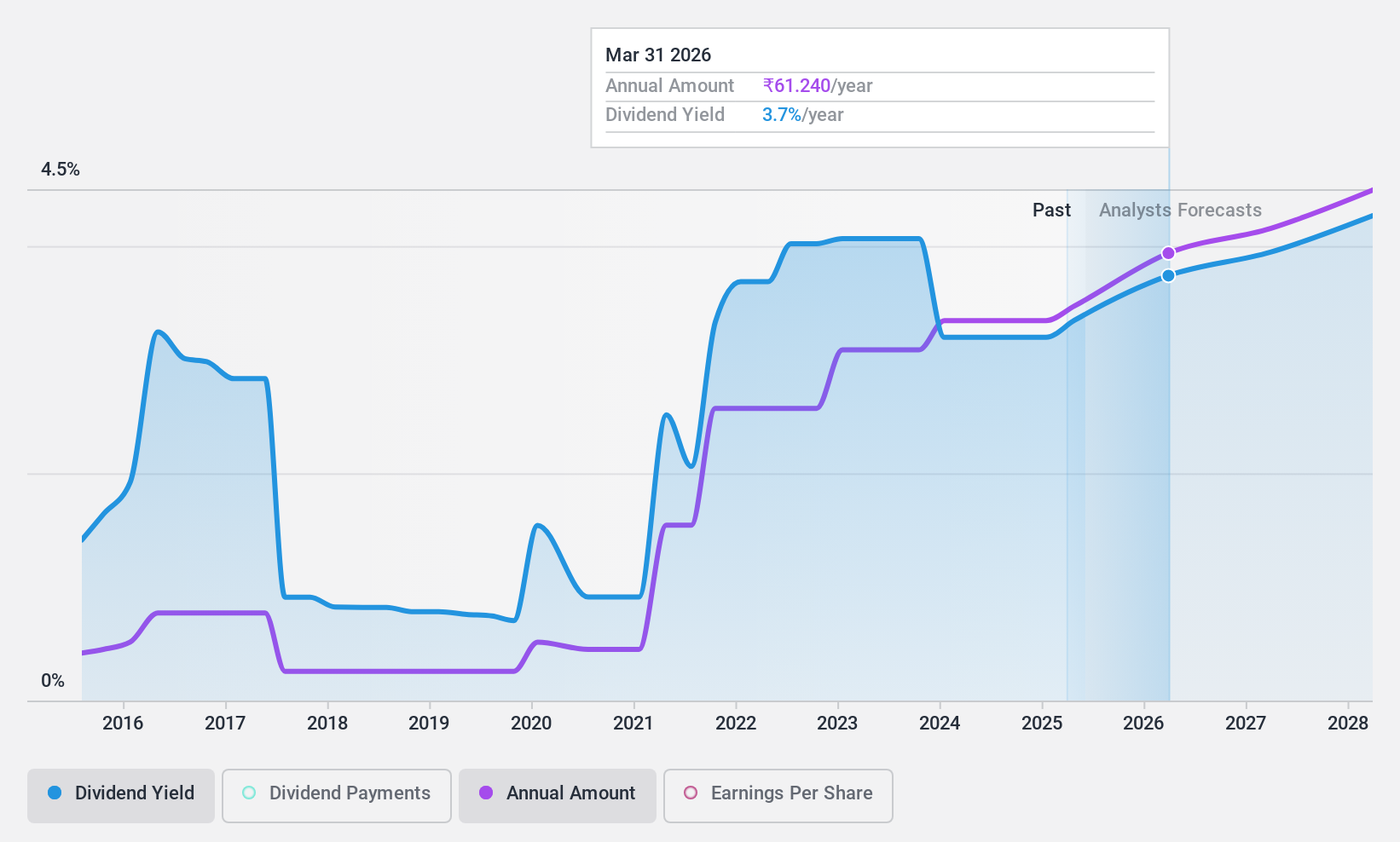

HCL Technologies (NSEI:HCLTECH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HCL Technologies Limited is a global company that provides software development, business process outsourcing, and infrastructure management services, with a market capitalization of approximately ₹3.61 trillion.

Operations: HCL Technologies generates revenue primarily through three segments: HCL Software at $1.41 billion, IT and Business Services at $9.80 billion, and Engineering and R&D Services at $2.12 billion.

Dividend Yield: 3.9%

HCL Technologies has demonstrated a stable yet modest growth in dividends, with an increase over the past decade, though it has experienced some volatility. The company maintains a high payout ratio of 89.1%, supported by earnings and a cash payout ratio of 65.1%, indicating reasonable coverage by cash flows. Despite this, its dividend track record shows instability which might concern conservative dividend investors. Recently, HCLTech declared an interim dividend of INR 18 per share for FY 2024-2025 and reported annual sales growth to US$13.27 billion from US$12.59 billion last year, reflecting steady financial progress.

- Navigate through the intricacies of HCL Technologies with our comprehensive dividend report here.

- Our valuation report here indicates HCL Technologies may be undervalued.

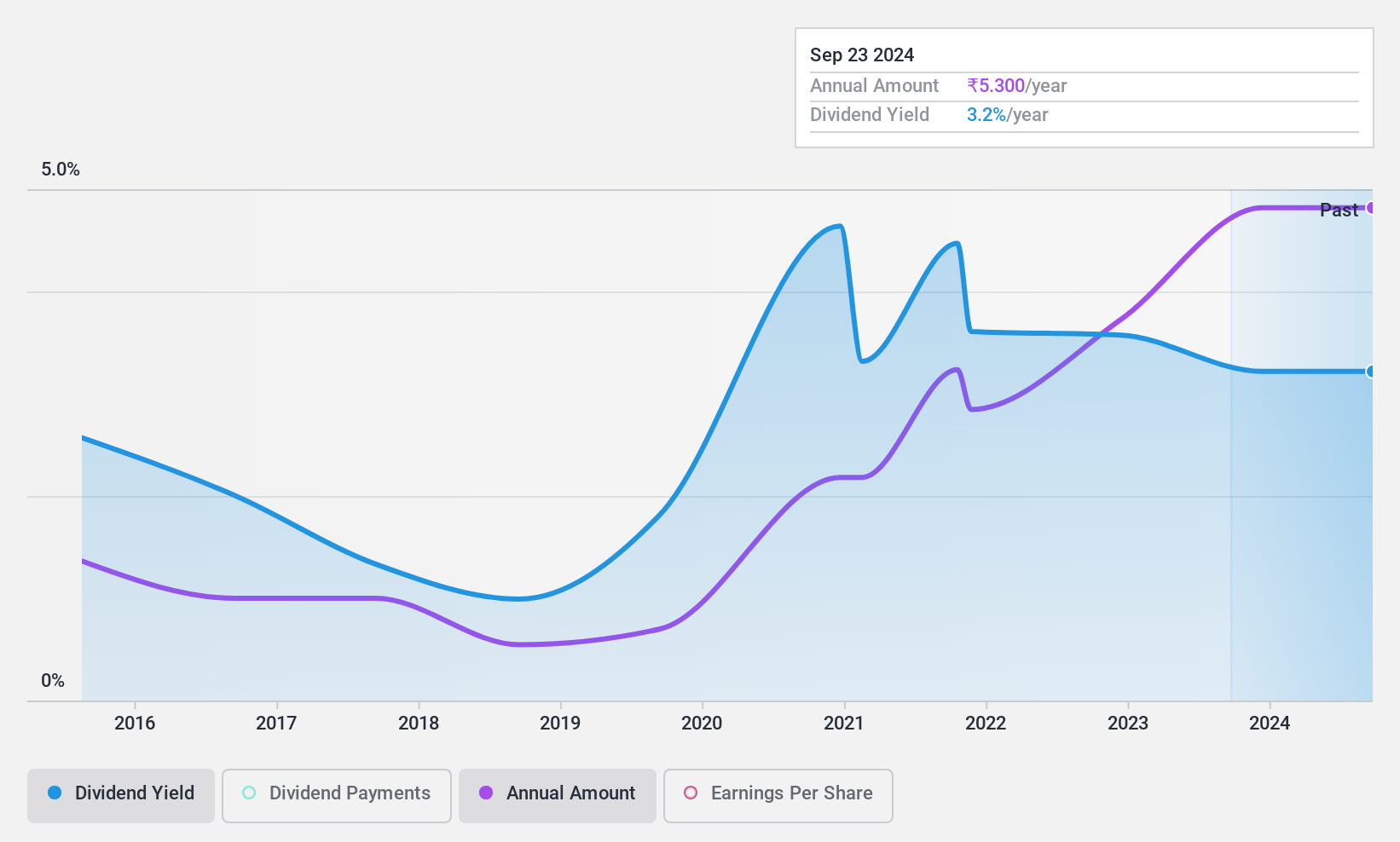

Rashtriya Chemicals and Fertilizers (NSEI:RCF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rashtriya Chemicals and Fertilizers Limited is an Indian company that manufactures, markets, and sells fertilizers and industrial chemicals, with a market capitalization of approximately ₹80.38 billion.

Operations: Rashtriya Chemicals and Fertilizers Limited generates revenue primarily through its fertilizers segment, which contributed ₹115.56 billion, followed by trading and industrial chemicals segments with revenues of ₹42.59 billion and ₹19.59 billion respectively.

Dividend Yield: 3.6%

Rashtriya Chemicals and Fertilizers (RCF) offers a dividend yield of 3.64%, ranking in the top quartile of Indian dividend payers. Despite its attractive yield, the company's dividend history is marked by volatility, with significant annual fluctuations over the past decade. However, RCF maintains a sustainable payout ratio at 70.4%, ensuring dividends are well-covered by earnings and exceptionally supported by cash flows with a cash payout ratio of only 8.9%. Recent executive changes could influence future strategies, as Ms. Ritu Goswami takes on dual roles within the company, potentially impacting operational focus and efficiency.

- Get an in-depth perspective on Rashtriya Chemicals and Fertilizers' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Rashtriya Chemicals and Fertilizers shares in the market.

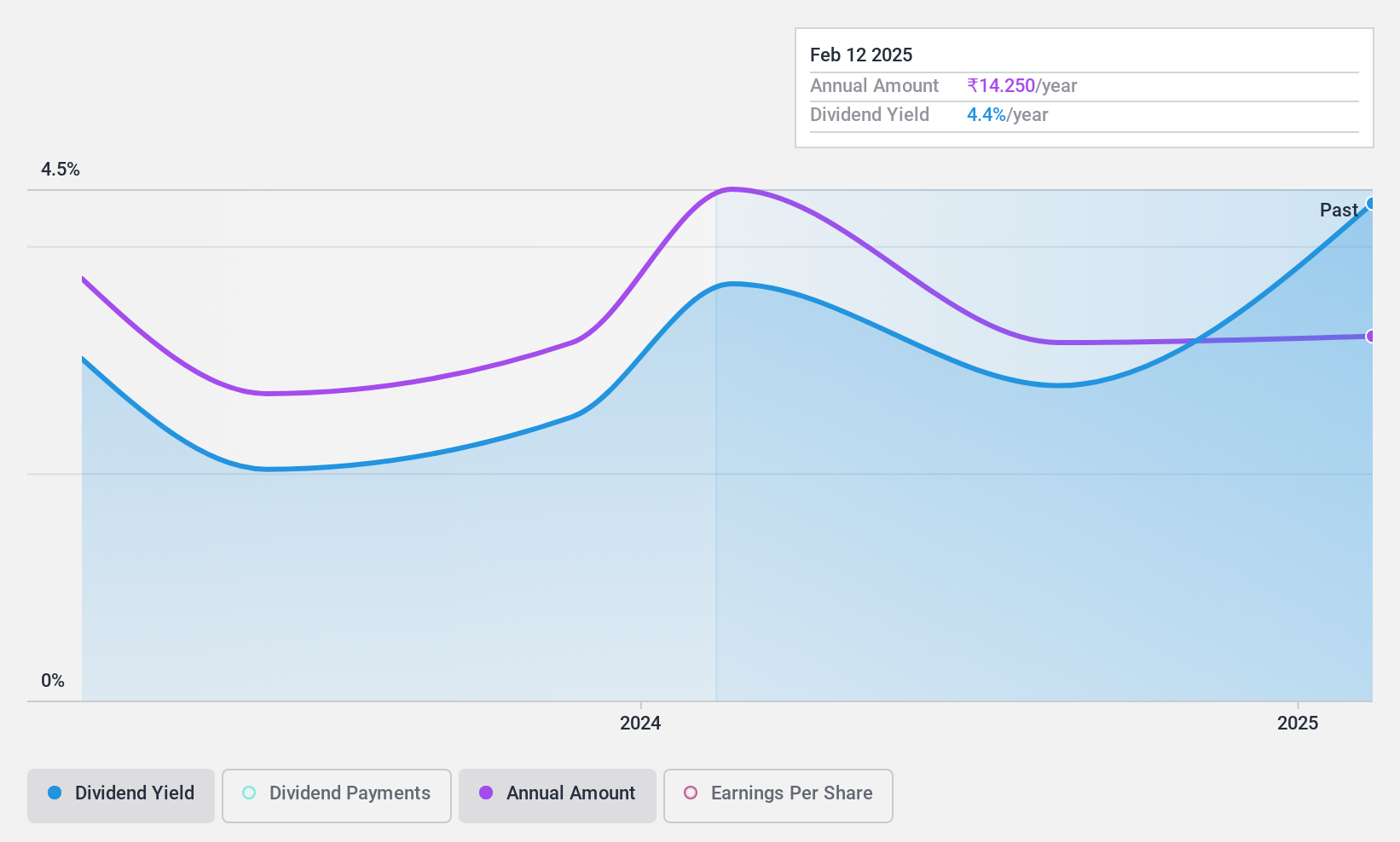

Uniparts India (NSEI:UNIPARTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Uniparts India Limited specializes in manufacturing and selling engineering systems, solutions, assemblies, and components for off-highway vehicles across various regions including India, the United States, Asia Pacific, Europe, and Japan, with a market capitalization of approximately ₹23.12 billion.

Operations: Uniparts India Limited generates its revenue primarily from the sale of linkage parts and components for off-highway vehicles, totaling ₹11.78 billion.

Dividend Yield: 3.8%

Uniparts India, with a dividend yield of 3.82%, ranks well among Indian dividend stocks. The company's dividends are supported by a payout ratio of 62.6% and a cash payout ratio of 34.7%, indicating sound financial management relative to earnings and cash flows. However, it's important to note that Uniparts has only recently begun issuing dividends, making long-term stability and growth assessments premature at this stage. Recent executive appointments suggest potential strategic shifts, enhancing its governance framework which could impact future dividend policies.

- Click here and access our complete dividend analysis report to understand the dynamics of Uniparts India.

- The analysis detailed in our Uniparts India valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Delve into our full catalog of 24 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UNIPARTS

Uniparts India

Manufactures and sells engineering systems, solutions, and assemblies primarily for off-highway vehicles in India, the United States, the Asia Pacific, Europe, Japan, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives