3 Indian Stocks That May Be Trading Below Estimated Value In October 2024

Reviewed by Simply Wall St

Over the last seven days, the Indian market has remained flat; however, over the past 12 months, it has experienced a significant rise of 40%, with earnings expected to grow by 17% per annum in the coming years. In this context of growth and stability, identifying stocks that may be trading below their estimated value can offer investors potential opportunities for capitalizing on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹514.08 | ₹964.62 | 46.7% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1170.05 | ₹2144.40 | 45.4% |

| RITES (NSEI:RITES) | ₹308.65 | ₹516.72 | 40.3% |

| Vedanta (NSEI:VEDL) | ₹472.15 | ₹899.37 | 47.5% |

| Patel Engineering (BSE:531120) | ₹56.69 | ₹92.23 | 38.5% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1335.60 | ₹2142.32 | 37.7% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹279.40 | ₹445.15 | 37.2% |

| Tarsons Products (NSEI:TARSONS) | ₹411.25 | ₹706.88 | 41.8% |

| Manorama Industries (BSE:541974) | ₹891.10 | ₹1665.51 | 46.5% |

| Strides Pharma Science (NSEI:STAR) | ₹1643.30 | ₹2704.30 | 39.2% |

We're going to check out a few of the best picks from our screener tool.

Prataap Snacks (NSEI:DIAMONDYD)

Overview: Prataap Snacks Limited manufactures and sells packaged snacks in India and internationally, with a market cap of ₹27.74 billion.

Operations: The company generates revenue of ₹16.52 billion from its snacks food segment.

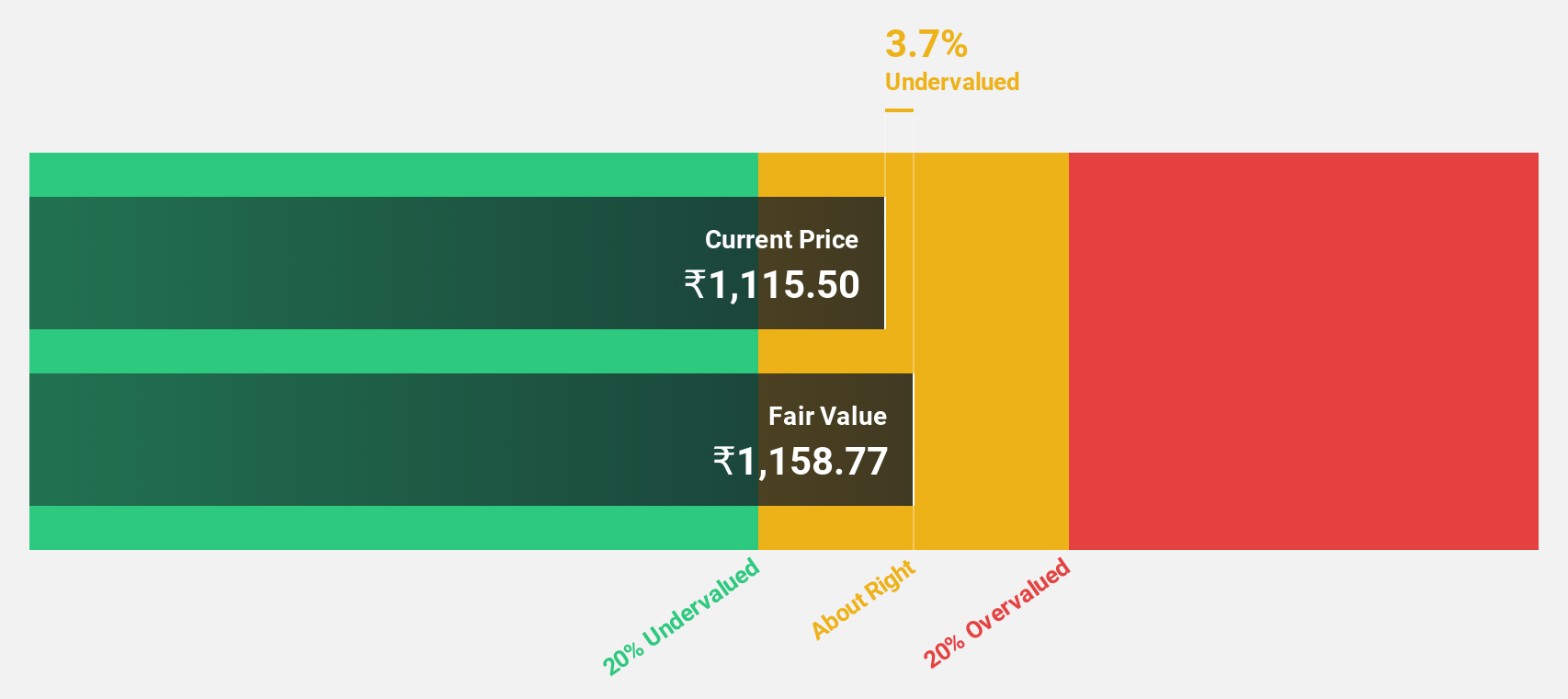

Estimated Discount To Fair Value: 23%

Prataap Snacks is trading 23% below its estimated fair value of ₹1509.79, suggesting it may be undervalued based on cash flows. Despite a recent decline in net income to ₹94.39 million for Q1 2024, earnings are forecast to grow significantly at 24.5% annually over the next three years, outpacing the Indian market's expected growth. However, significant insider selling and a low projected return on equity of 9.3% could be concerns for investors.

- Our expertly prepared growth report on Prataap Snacks implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Prataap Snacks with our detailed financial health report.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across various international markets, with a market cap of ₹151.11 billion.

Operations: The company's primary revenue segment is its pharmaceutical business, excluding bio-pharmaceuticals, which generated ₹42.09 billion.

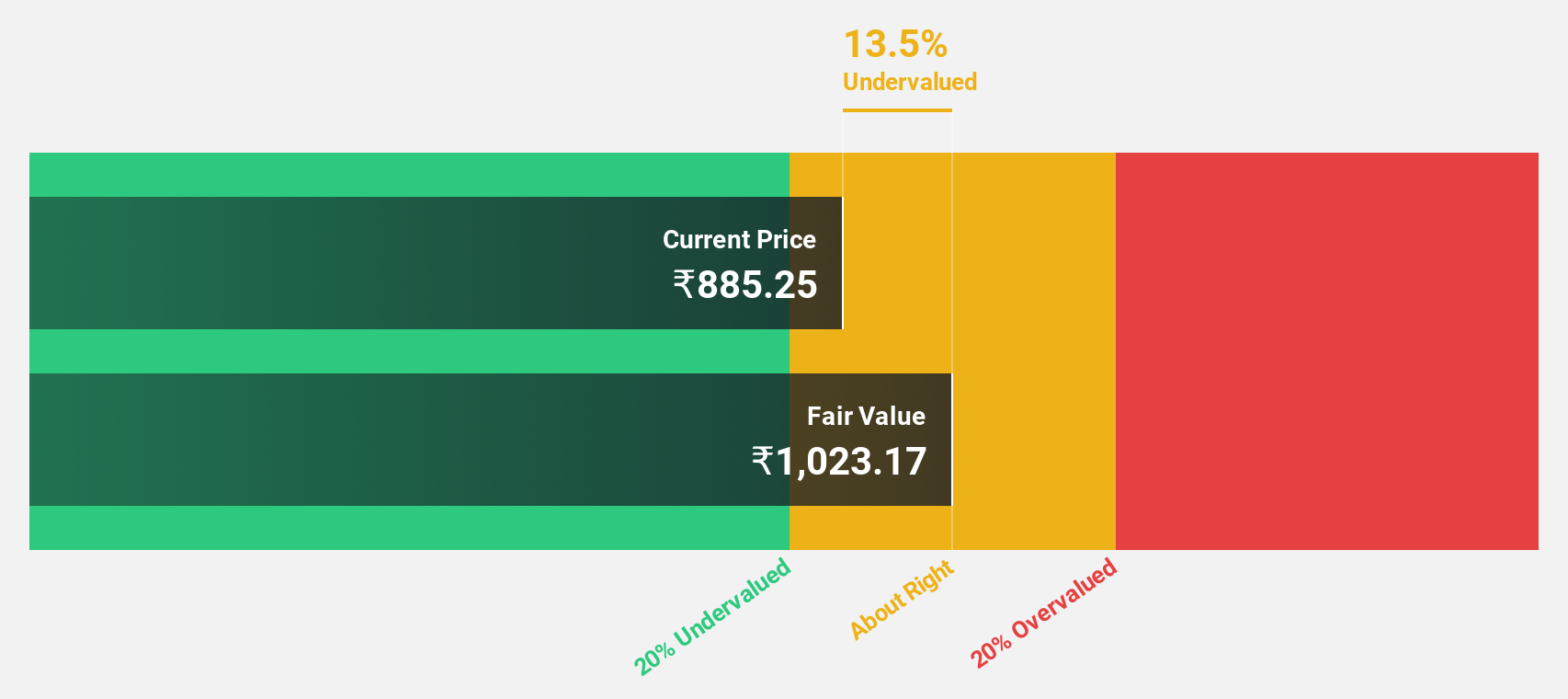

Estimated Discount To Fair Value: 39.2%

Strides Pharma Science is trading 39.2% below its estimated fair value of ₹2,704.3, indicating potential undervaluation based on cash flows. Recent financial results show a turnaround with net income reaching ₹702.02 million in Q1 2024 after a prior loss, and revenue growth outpacing the Indian market at 11.4% annually. The company has also reduced its debt significantly by redeeming non-convertible debentures worth ₹1 billion recently, enhancing its financial stability.

- The growth report we've compiled suggests that Strides Pharma Science's future prospects could be on the up.

- Navigate through the intricacies of Strides Pharma Science with our comprehensive financial health report here.

Titagarh Rail Systems (NSEI:TITAGARH)

Overview: Titagarh Rail Systems Limited manufactures and sells freight and passenger rail systems in India and internationally, with a market cap of ₹157.58 billion.

Operations: The company's revenue segments consist of ₹3.32 billion from Passenger Rail Systems and ₹35.14 billion from Freight Rail Systems, which includes shipbuilding, bridges, and defense.

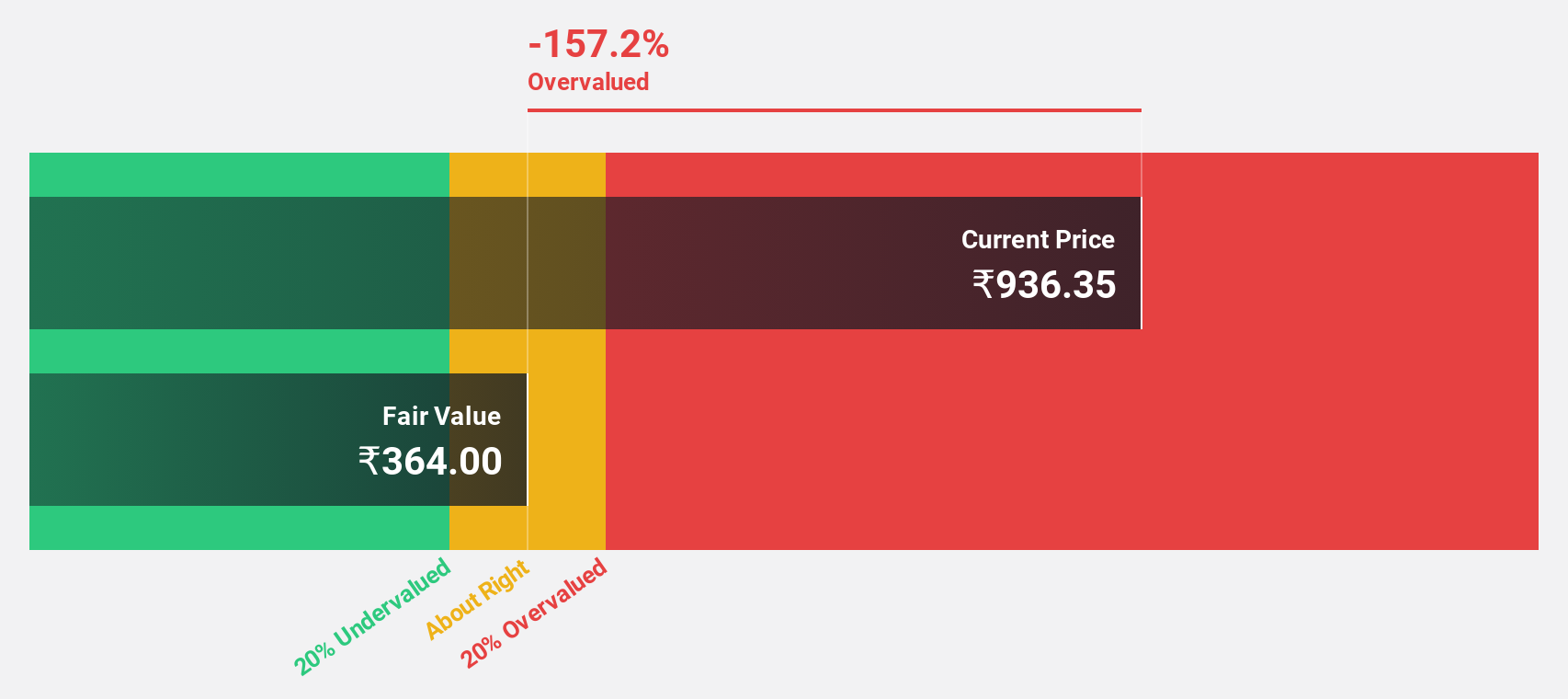

Estimated Discount To Fair Value: 45.4%

Titagarh Rail Systems is trading at ₹1,170.05, significantly below its estimated fair value of ₹2,144.4, highlighting potential undervaluation based on cash flows. Despite past shareholder dilution and low future return on equity forecasts (18.6%), earnings are expected to grow at 30.1% annually—outpacing the Indian market's 17.4%. Recent contract adjustments with Indian Railways have optimized capacity utilization and mitigated potential penalties, supporting financial health amidst strong revenue growth projections of 25.7% per year.

- Insights from our recent growth report point to a promising forecast for Titagarh Rail Systems' business outlook.

- Dive into the specifics of Titagarh Rail Systems here with our thorough financial health report.

Make It Happen

- Reveal the 26 hidden gems among our Undervalued Indian Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Titagarh Rail Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TITAGARH

Titagarh Rail Systems

Engages in the manufacture and sale of freight and passenger rail systems in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026