Texmaco Rail & Engineering's (NSE:TEXRAIL) Earnings Are Of Questionable Quality

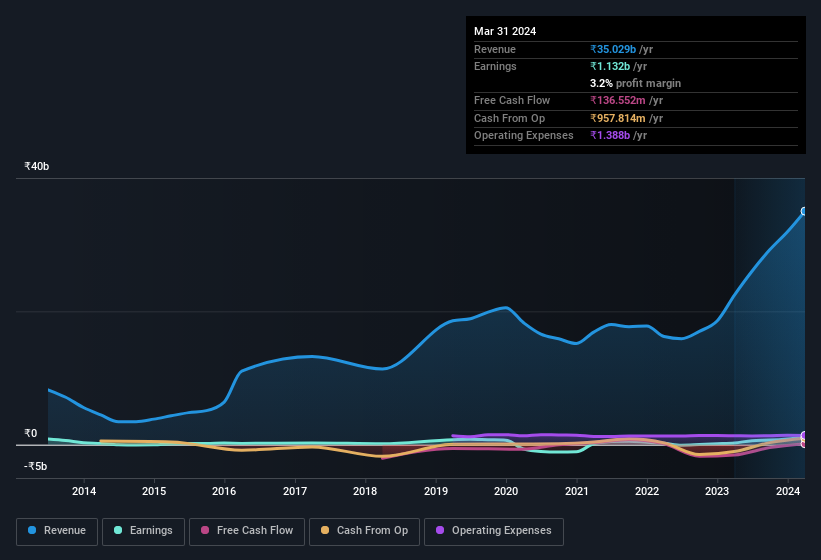

Texmaco Rail & Engineering Limited's (NSE:TEXRAIL) stock was strong after they recently reported robust earnings. However, we think that shareholders may be missing some concerning details in the numbers.

See our latest analysis for Texmaco Rail & Engineering

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Texmaco Rail & Engineering increased the number of shares on issue by 24% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Texmaco Rail & Engineering's EPS by clicking here.

How Is Dilution Impacting Texmaco Rail & Engineering's Earnings Per Share (EPS)?

Texmaco Rail & Engineering has improved its profit over the last three years, with an annualized gain of 700% in that time. In comparison, earnings per share only gained 429% over the same period. And at a glance the 335% gain in profit over the last year impresses. But in comparison, EPS only increased by 307% over the same period. So you can see that the dilution has had a fairly significant impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So Texmaco Rail & Engineering shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Texmaco Rail & Engineering.

Our Take On Texmaco Rail & Engineering's Profit Performance

Each Texmaco Rail & Engineering share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Therefore, it seems possible to us that Texmaco Rail & Engineering's true underlying earnings power is actually less than its statutory profit. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Texmaco Rail & Engineering as a business, it's important to be aware of any risks it's facing. For example - Texmaco Rail & Engineering has 2 warning signs we think you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Texmaco Rail & Engineering's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Texmaco Rail & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TEXRAIL

Texmaco Rail & Engineering

Manufactures, sells, and provides services for rail and rail related products in India and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives