3 Indian Exchange Stocks Estimated To Be Undervalued In July 2024

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, rising by 2.3% in the last week and an impressive 45% over the past year, with earnings expected to grow by 16% annually. In this thriving market environment, identifying stocks that are potentially undervalued could offer investors a strategic advantage.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HEG (NSEI:HEG) | ₹2111.75 | ₹3300.29 | 36% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹426.60 | ₹636.71 | 33% |

| Updater Services (NSEI:UDS) | ₹318.80 | ₹536.78 | 40.6% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2211.45 | ₹3586.71 | 38.3% |

| Vedanta (NSEI:VEDL) | ₹448.95 | ₹721.52 | 37.8% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹315.35 | ₹508.03 | 37.9% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹530.65 | ₹855.39 | 38% |

| Strides Pharma Science (NSEI:STAR) | ₹1030.15 | ₹1664.05 | 38.1% |

| Delhivery (NSEI:DELHIVERY) | ₹412.40 | ₹751.11 | 45.1% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3129.85 | ₹5531.73 | 43.4% |

Let's dive into some prime choices out of the screener.

Delhivery (NSEI:DELHIVERY)

Overview: Delhivery Limited offers supply chain solutions to a diverse range of industries including e-commerce, FMCG, and automotive in India, with a market capitalization of approximately ₹304.85 billion.

Operations: The revenue from logistics services for the company amounts to ₹81.42 billion.

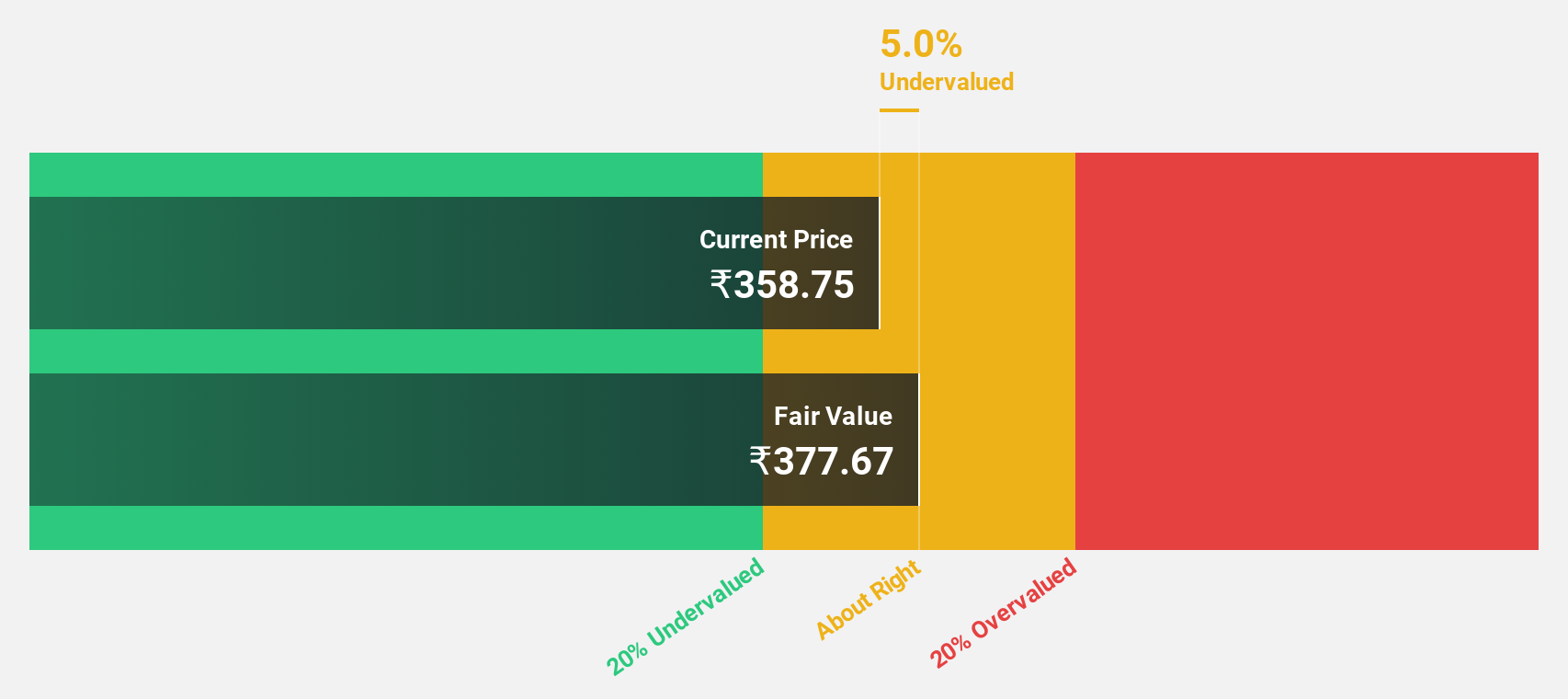

Estimated Discount To Fair Value: 45.1%

Delhivery, currently valued at ₹412.4, is trading significantly below its fair value estimate of ₹751.11, indicating a potential undervaluation of over 45%. Despite a challenging market, Delhivery has demonstrated robust earnings growth at an annual rate of 16.5% over the past five years and is expected to turn profitable within the next three years with forecasted profit growth outpacing the market. However, its revenue growth projection of 14.3% annually lags behind more aggressive market averages but still exceeds general Indian market expectations. Recent strategic executive appointments and expansions into new business areas like drone logistics suggest operational enhancements that might support future financial performance despite current forecasts showing a low return on equity in three years' time.

- Insights from our recent growth report point to a promising forecast for Delhivery's business outlook.

- Click here to discover the nuances of Delhivery with our detailed financial health report.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited is a global pharmaceutical company with operations across North America, Europe, Japan, and India, boasting a market capitalization of approximately ₹225.75 billion.

Operations: The company generates ₹83.73 billion in revenue from its pharmaceutical segment.

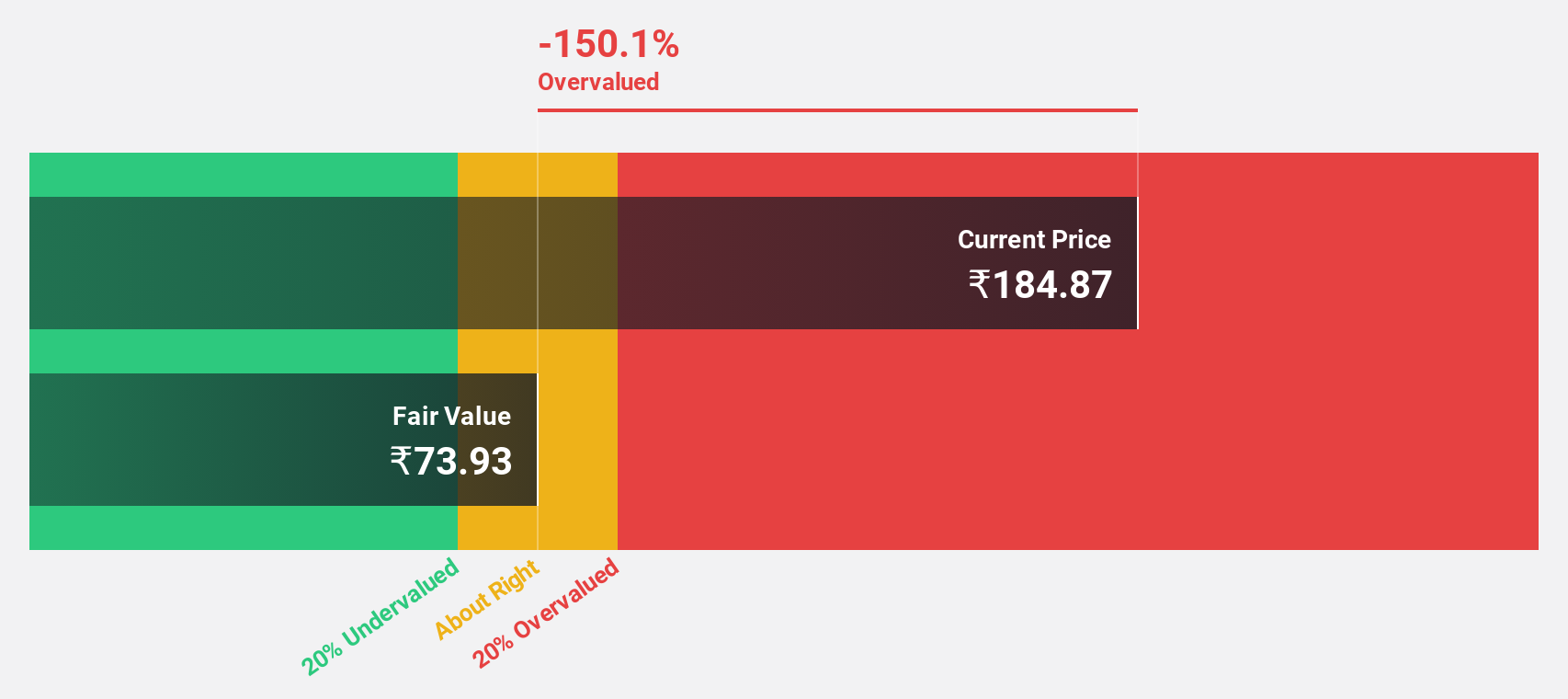

Estimated Discount To Fair Value: 14.8%

Piramal Pharma, priced at ₹170.28, is undervalued by approximately 14.8% against a fair value of ₹199.96, reflecting potential investment appeal based on cash flows. The company's revenue and earnings growth forecasts are robust, outstripping the broader Indian market with expected annual increases of 12.2% and 73%, respectively. However, challenges include a recent net loss and regulatory penalties that may impact short-term performance but are not expected to materially affect long-term operations.

- According our earnings growth report, there's an indication that Piramal Pharma might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Piramal Pharma.

Texmaco Rail & Engineering (NSEI:TEXRAIL)

Overview: Texmaco Rail & Engineering Limited is an engineering and infrastructure company based in India, operating both domestically and internationally, with a market capitalization of approximately ₹112.53 billion.

Operations: The company's revenue is generated primarily from three segments: the Freight Car Division contributes ₹27.50 billion, while the Infra - Electrical and Infra - Rail & Green Energy segments add ₹2.26 billion and ₹5.27 billion, respectively.

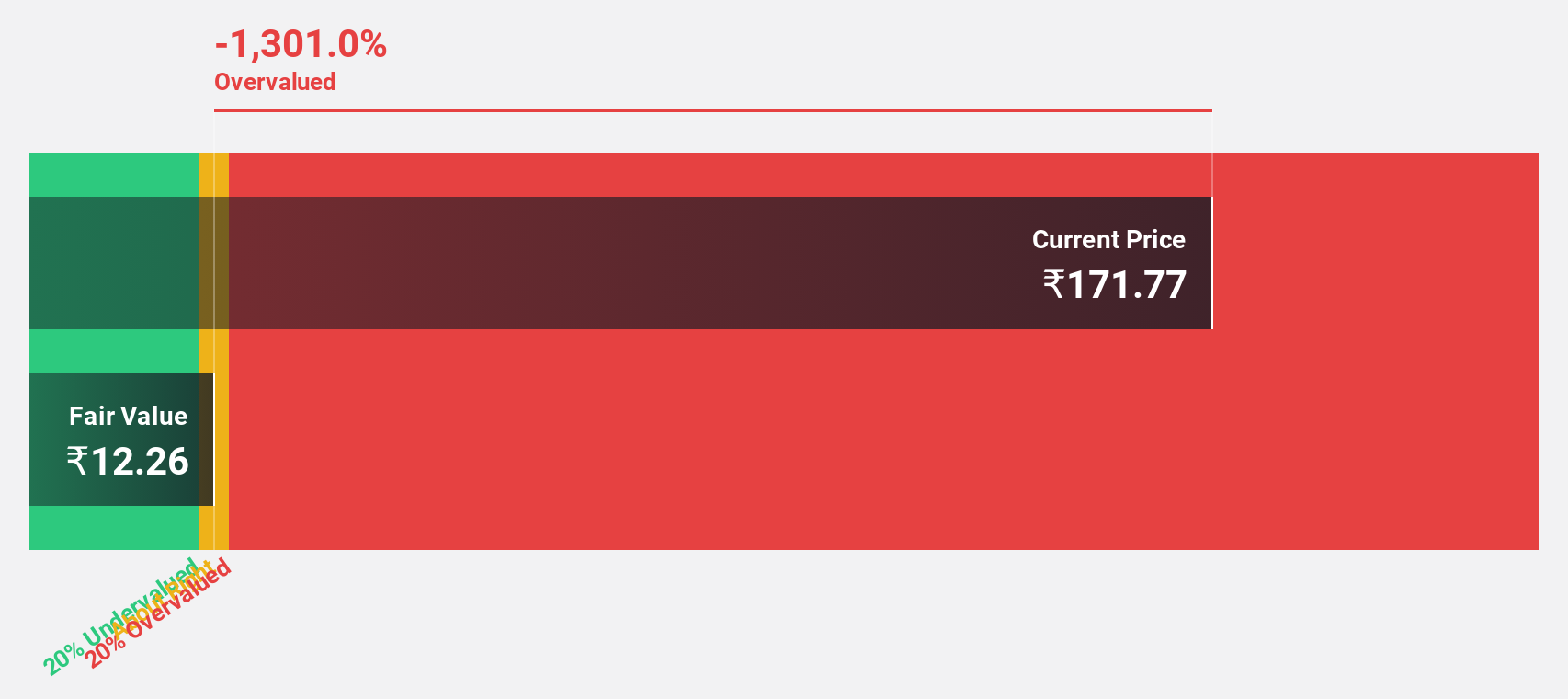

Estimated Discount To Fair Value: 14.3%

Texmaco Rail & Engineering, currently priced at ₹281.71, is positioned below its estimated fair value of ₹328.65, suggesting a potential undervaluation based on cash flows. The company's revenue growth forecast at 14.2% annually is robust, though not exceeding 20%, and its earnings are expected to rise by 28.9% per year, surpassing the Indian market's average of 15.7%. However, recent shareholder dilution and a highly volatile share price may pose risks to investors despite these positive growth indicators and a recent dividend increase announcement on May 16, 2024.

- Upon reviewing our latest growth report, Texmaco Rail & Engineering's projected financial performance appears quite optimistic.

- Dive into the specifics of Texmaco Rail & Engineering here with our thorough financial health report.

Taking Advantage

- Get an in-depth perspective on all 19 Undervalued Indian Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texmaco Rail & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TEXRAIL

Texmaco Rail & Engineering

Manufactures, sells, and provides services for rail and rail related products in India and internationally.

Undervalued with solid track record.