In the past year, the Indian stock market has experienced a significant upswing, with an impressive 44% increase despite a recent 1.5% dip over the last week. In this context of robust growth and anticipated earnings expansion of 16% annually, identifying stocks that remain under the radar yet hold potential for substantial value can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Voith Paper Fabrics India | NA | 10.79% | 9.57% | ★★★★★★ |

| Yuken India | 27.52% | 9.91% | -52.98% | ★★★★★★ |

| Bengal & Assam | 4.48% | 3.82% | 47.41% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Genesys International | 10.57% | 13.38% | 27.53% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Master Trust | 37.05% | 26.63% | 41.10% | ★★★★☆☆ |

| Apollo Micro Systems | 38.17% | 7.94% | 2.46% | ★★★★☆☆ |

| SG Mart | 16.73% | 99.32% | 94.08% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Dodla Dairy (NSEI:DODLA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dodla Dairy Limited operates in the production and sale of milk and dairy products both domestically in India and internationally, with a market capitalization of ₹74.09 billion.

Operations: The company generates its revenue primarily from the sale of milk and milk products, which totaled ₹31.25 billion as of the latest reporting period. Its business model reflects a gross profit margin of 26.85%, indicating the efficiency with which it converts sales into gross profit, while managing costs associated with goods sold at ₹22.86 billion in the same period.

Dodla Dairy, a notable player in the Indian dairy sector, has demonstrated robust financial health and growth potential. Over the past five years, its debt-to-equity ratio impressively decreased from 38.8% to 2.6%, reflecting strong financial management. The company's earnings outpaced the industry with a growth of 36.4% last year against the food industry's average of 13.7%. Looking ahead, Dodla is expected to sustain this momentum with projected annual earnings growth of 23.86%.

- Delve into the full analysis health report here for a deeper understanding of Dodla Dairy.

Explore historical data to track Dodla Dairy's performance over time in our Past section.

Orchid Pharma (NSEI:ORCHPHARMA)

Simply Wall St Value Rating: ★★★★★★

Overview: Orchid Pharma Limited is a pharmaceutical company in India specializing in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals, with a market capitalization of ₹70.17 billion.

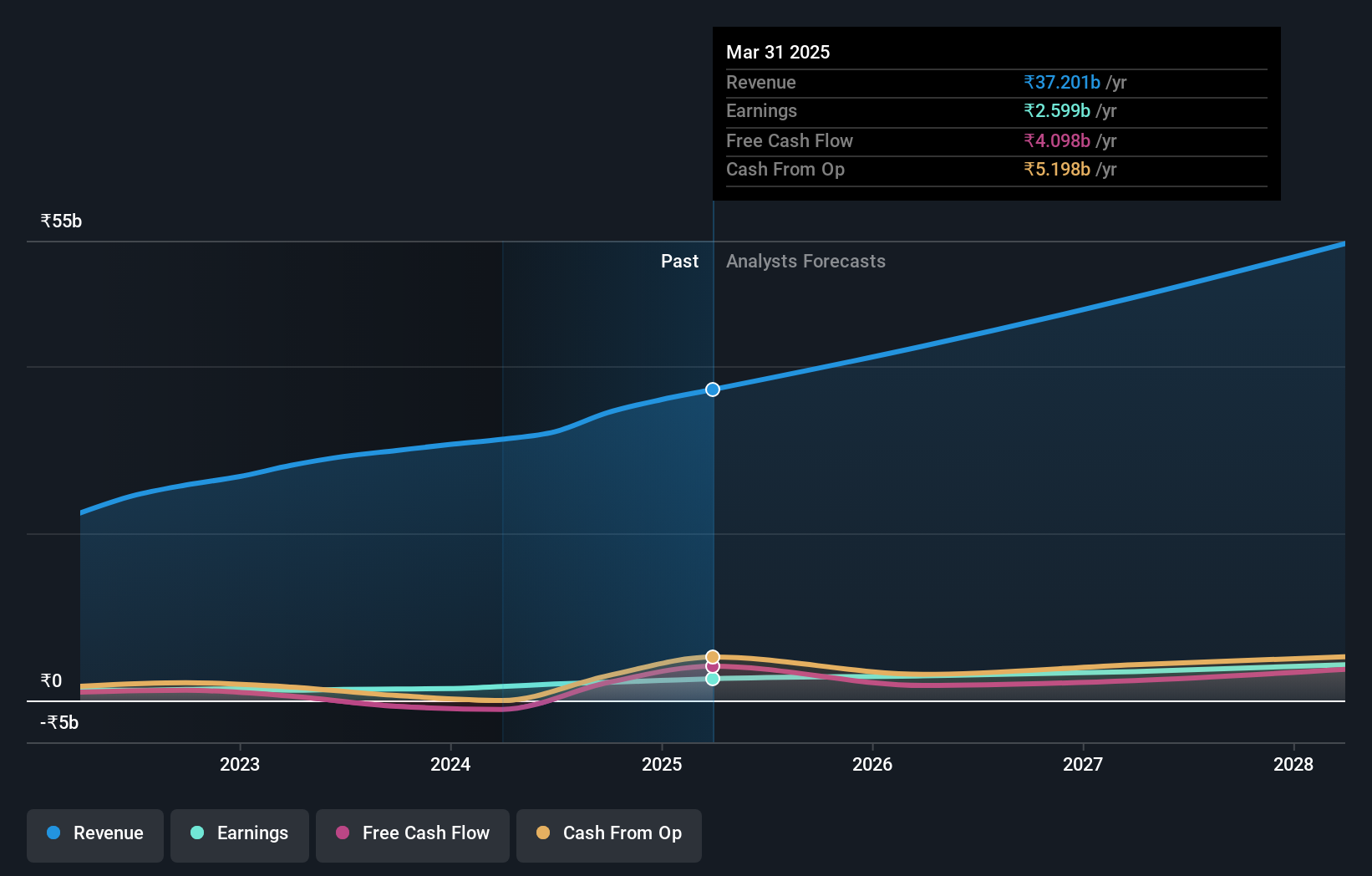

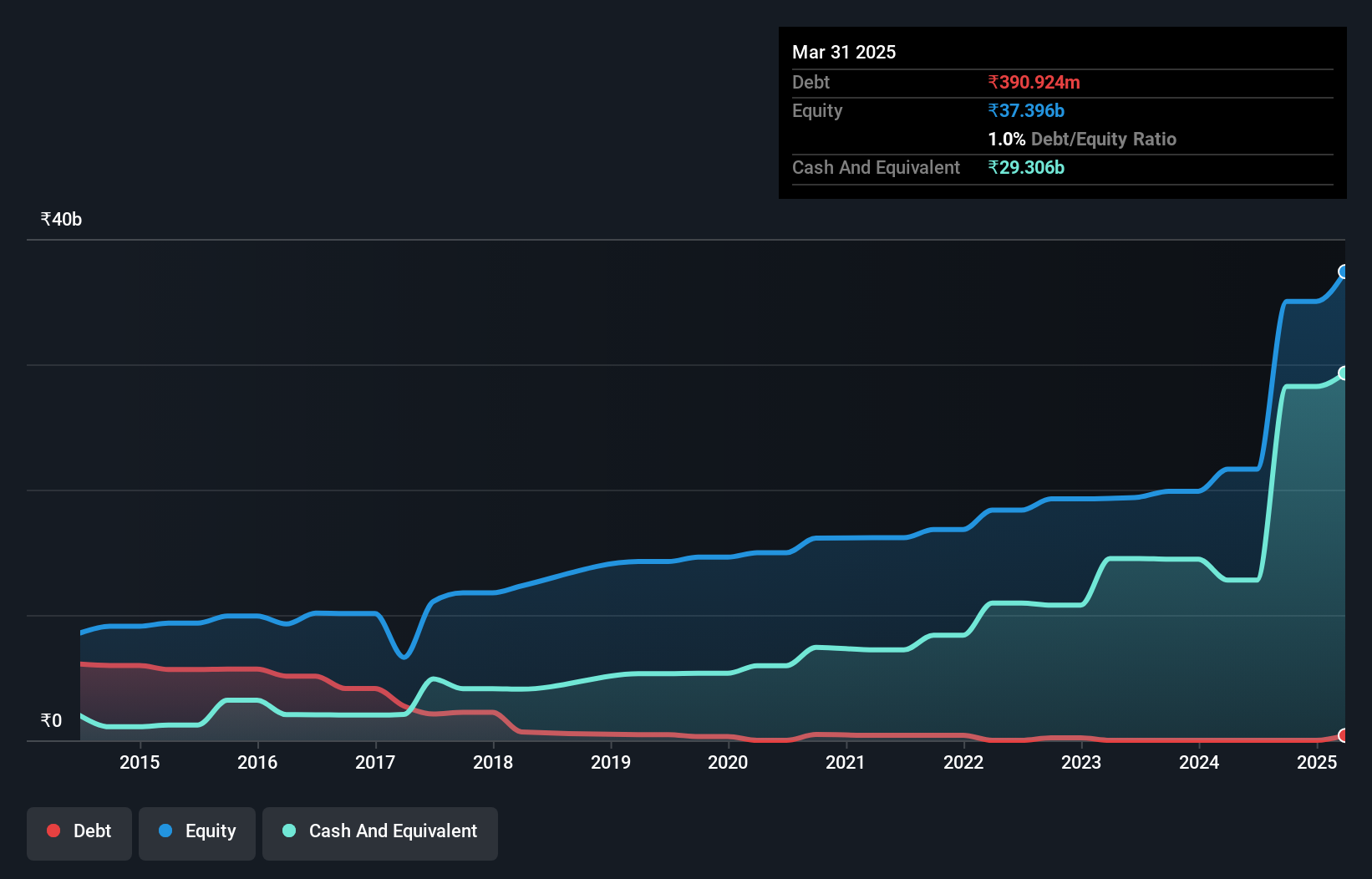

Operations: Orchid Pharma primarily engages in the pharmaceuticals sector, generating a revenue of ₹8.19 billion as of the latest reporting period. The company's business model involves substantial operating expenses and cost of goods sold, which consistently impact its financial performance, reflecting a complex interplay between gross profit generation and operational costs management.

Orchid Pharma, an emerging leader in the pharmaceutical sector, exemplifies a hidden gem with its robust performance and strategic initiatives. The company's earnings surged by 74% last year, outpacing the industry's growth of 17%. Forecasted to grow at 42% annually, Orchid Pharma also boasts a strong financial position with more cash than debt. Recent launches like Cefepime-Enmetazobactam in collaboration with Cipla highlight its innovative capabilities and commitment to addressing critical healthcare needs.

- Navigate through the intricacies of Orchid Pharma with our comprehensive health report here.

Gain insights into Orchid Pharma's historical performance by reviewing our past performance report.

Techno Electric & Engineering (NSEI:TECHNOE)

Simply Wall St Value Rating: ★★★★★★

Overview: Techno Electric & Engineering Company Limited specializes in engineering, procurement, and construction (EPC) services for the power generation, transmission, and distribution sectors in India, with a market capitalization of ₹166.88 billion.

Operations: Techno Electric & Engineering primarily operates in the EPC (Engineering, Procurement, and Construction) sector, generating a significant portion of its revenue from construction-related activities, evidenced by ₹14.92 billion in construction segment revenues. The company also engages in other business activities contributing ₹104.38 million to its total revenue stream.

Techno Electric & Engineering, a lesser-known entity in India's construction sector, has outpaced industry growth with a 180.5% earnings increase last year, significantly higher than the industry's 36.5%. Now debt-free, a stark contrast to its debt-to-equity ratio of 3.1 five years ago, the company is poised for continued expansion with earnings expected to grow by 27.48% annually. Recent achievements include securing new orders worth INR 40,630 million and reporting a substantial rise in quarterly revenue to INR 4,708.77 million from INR 3,356.48 million the previous year.

Where To Now?

- Navigate through the entire inventory of 448 Indian Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ORCHPHARMA

Orchid Pharma

A pharmaceutical company, engages in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives