- India

- /

- Trade Distributors

- /

- NSEI:TARACHAND

Returns At Tara Chand Logistic Solutions (NSE:TARACHAND) Appear To Be Weighed Down

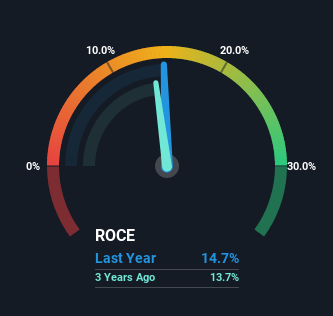

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. With that in mind, the ROCE of Tara Chand Logistic Solutions (NSE:TARACHAND) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Tara Chand Logistic Solutions is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = ₹151m ÷ (₹1.9b - ₹873m) (Based on the trailing twelve months to December 2022).

Thus, Tara Chand Logistic Solutions has an ROCE of 15%. In absolute terms, that's a satisfactory return, but compared to the Trade Distributors industry average of 6.0% it's much better.

See our latest analysis for Tara Chand Logistic Solutions

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Tara Chand Logistic Solutions' past further, check out this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

While the returns on capital are good, they haven't moved much. The company has employed 55% more capital in the last five years, and the returns on that capital have remained stable at 15%. 15% is a pretty standard return, and it provides some comfort knowing that Tara Chand Logistic Solutions has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 46% of total assets, this reported ROCE would probably be less than15% because total capital employed would be higher.The 15% ROCE could be even lower if current liabilities weren't 46% of total assets, because the the formula would show a larger base of total capital employed. Additionally, this high level of current liabilities isn't ideal because it means the company's suppliers (or short-term creditors) are effectively funding a large portion of the business.

The Bottom Line On Tara Chand Logistic Solutions' ROCE

In the end, Tara Chand Logistic Solutions has proven its ability to adequately reinvest capital at good rates of return. And long term investors would be thrilled with the 111% return they've received over the last three years. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 4 warning signs for Tara Chand Logistic Solutions (of which 3 are a bit unpleasant!) that you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Tara Chand Infralogistic Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TARACHAND

Tara Chand Infralogistic Solutions

Provides logistics solutions in India.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026