- India

- /

- Construction

- /

- NSEI:SWSOLAR

If You Had Bought Sterling and Wilson Solar's (NSE:SWSOLAR) Shares A Year Ago You Would Be Down 23%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Sterling and Wilson Solar Limited (NSE:SWSOLAR) shareholders over the last year, as the share price declined 23%. That contrasts poorly with the market return of 25%. We wouldn't rush to judgement on Sterling and Wilson Solar because we don't have a long term history to look at. Unfortunately the share price momentum is still quite negative, with prices down 10% in thirty days.

View our latest analysis for Sterling and Wilson Solar

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

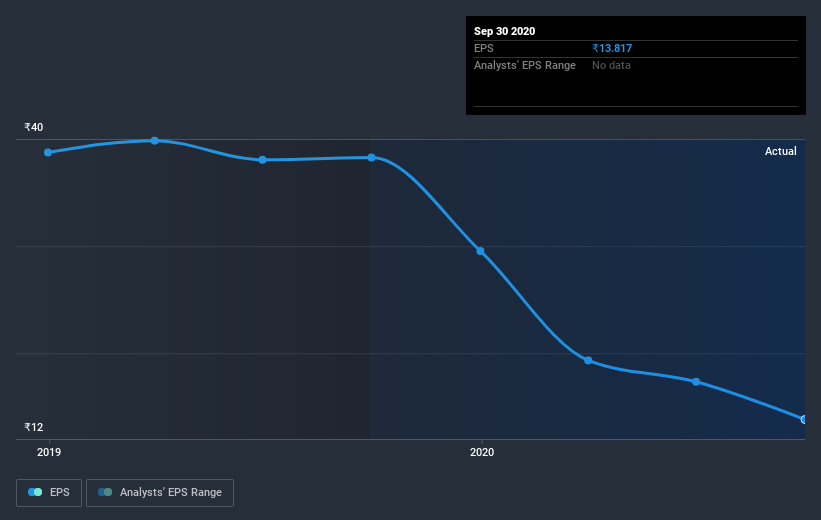

Unhappily, Sterling and Wilson Solar had to report a 64% decline in EPS over the last year. This fall in the EPS is significantly worse than the 23% the share price fall. It may have been that the weak EPS was not as bad as some had feared.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Sterling and Wilson Solar's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Sterling and Wilson Solar, it has a TSR of -21% for the last year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Given that the market gained 25% in the last year, Sterling and Wilson Solar shareholders might be miffed that they lost 21% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 9.3% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 6 warning signs we've spotted with Sterling and Wilson Solar (including 1 which makes us a bit uncomfortable) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Sterling and Wilson Solar or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SWSOLAR

Sterling and Wilson Renewable Energy

Engages in the provision of engineering, procurement, and construction (EPC) services to solar power projects.

Exceptional growth potential with excellent balance sheet.