- India

- /

- Construction

- /

- NSEI:SWSOLAR

One Forecaster Is Now More Bearish On Sterling and Wilson Renewable Energy Limited (NSE:SWSOLAR) Than They Used To Be

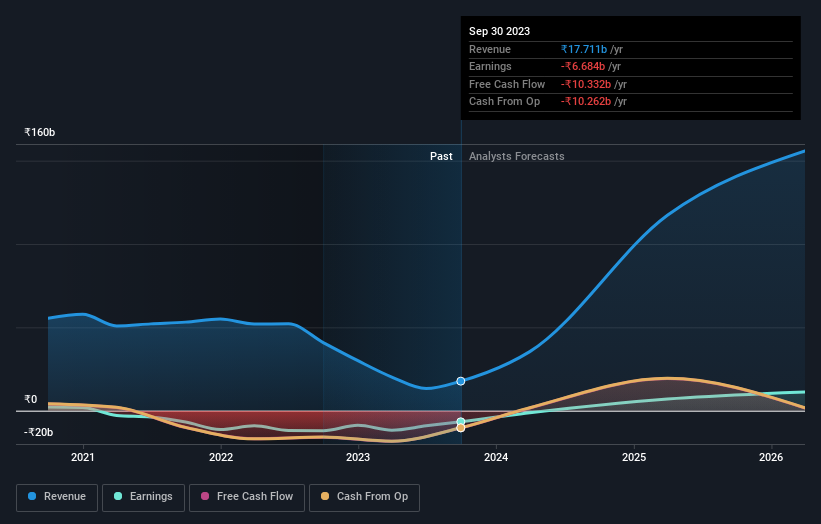

Market forces rained on the parade of Sterling and Wilson Renewable Energy Limited (NSE:SWSOLAR) shareholders today, when the covering analyst downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analyst seeing grey clouds on the horizon.

Following the downgrade, the current consensus from Sterling and Wilson Renewable Energy's sole analyst is for revenues of ₹35b in 2024 which - if met - would reflect a sizeable 100% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 81% to ₹5.50 per share. Before this latest update, the analyst had been forecasting revenues of ₹58b and earnings per share (EPS) of ₹4.10 in 2024. There looks to have been a major change in sentiment regarding Sterling and Wilson Renewable Energy's prospects, with a sizeable cut to revenues and the analyst now forecasting a loss instead of a profit.

View our latest analysis for Sterling and Wilson Renewable Energy

The analyst lifted their price target 37% to ₹620, implicitly signalling that lower earnings per share are not expected to have a longer-term impact on the stock's value.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Sterling and Wilson Renewable Energy's past performance and to peers in the same industry. For example, we noticed that Sterling and Wilson Renewable Energy's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 152% growth to the end of 2024 on an annualised basis. That is well above its historical decline of 24% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 12% per year. Not only are Sterling and Wilson Renewable Energy's revenues expected to improve, it seems that the analyst is also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analyst is expecting Sterling and Wilson Renewable Energy to become unprofitable this year. While the analyst did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. The increasing price target is not intuitively what we would expect to see, given these downgrades, and we'd suggest shareholders revisit their investment thesis before making a decision.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Sterling and Wilson Renewable Energy's business, like dilutive stock issuance over the past year. For more information, you can click here to discover this and the 1 other risk we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SWSOLAR

Sterling and Wilson Renewable Energy

Provides renewable engineering, procurement, and construction (EPC) services in India, Europe, the Middle East, North Africa, rest of Africa, the United States, Latin America, and Australia.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026