- India

- /

- Construction

- /

- NSEI:SKIPPER

Skipper Limited's (NSE:SKIPPER) P/E Is Still On The Mark Following 27% Share Price Bounce

Despite an already strong run, Skipper Limited (NSE:SKIPPER) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 126% following the latest surge, making investors sit up and take notice.

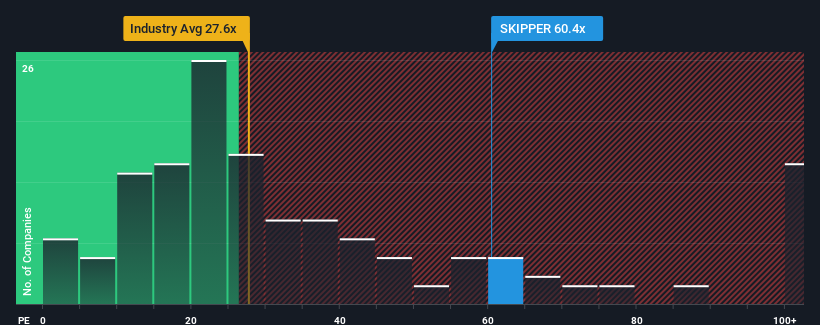

After such a large jump in price, Skipper's price-to-earnings (or "P/E") ratio of 60.4x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 33x and even P/E's below 19x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Skipper certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Skipper

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Skipper's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 78% gain to the company's bottom line. Pleasingly, EPS has also lifted 285% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 37% per year over the next three years. With the market only predicted to deliver 21% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Skipper is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has got Skipper's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Skipper maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 3 warning signs for Skipper (1 is significant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SKIPPER

Skipper

Manufactures and sells transmission and distribution structures, telecom towers, and fasteners in India.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives