Rolex Rings Limited (NSE:ROLEXRINGS) Doing What It Can To Lift Shares

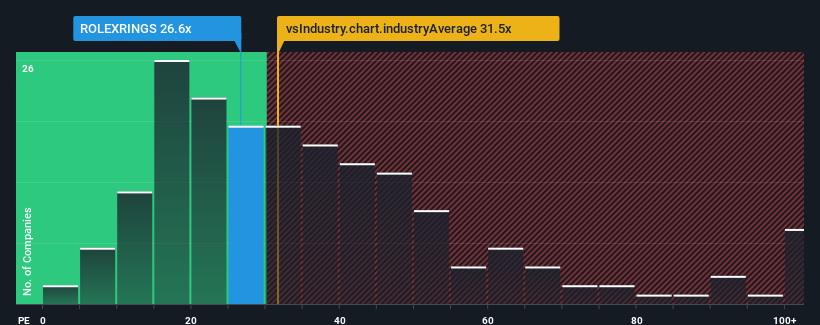

With a median price-to-earnings (or "P/E") ratio of close to 27x in India, you could be forgiven for feeling indifferent about Rolex Rings Limited's (NSE:ROLEXRINGS) P/E ratio of 26.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

We've discovered 1 warning sign about Rolex Rings. View them for free.Rolex Rings could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Rolex Rings

Does Growth Match The P/E?

Rolex Rings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 47% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 24% growth forecast for the broader market.

With this information, we find it interesting that Rolex Rings is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Rolex Rings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 1 warning sign for Rolex Rings that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Rolex Rings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ROLEXRINGS

Rolex Rings

Manufactures and sells machined and forged bearing rings and automotive components in India and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives