If EPS Growth Is Important To You, Rex Pipes and Cables Industries (NSE:REXPIPES) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Rex Pipes and Cables Industries (NSE:REXPIPES), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Rex Pipes and Cables Industries

Rex Pipes and Cables Industries' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Rex Pipes and Cables Industries' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 42%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

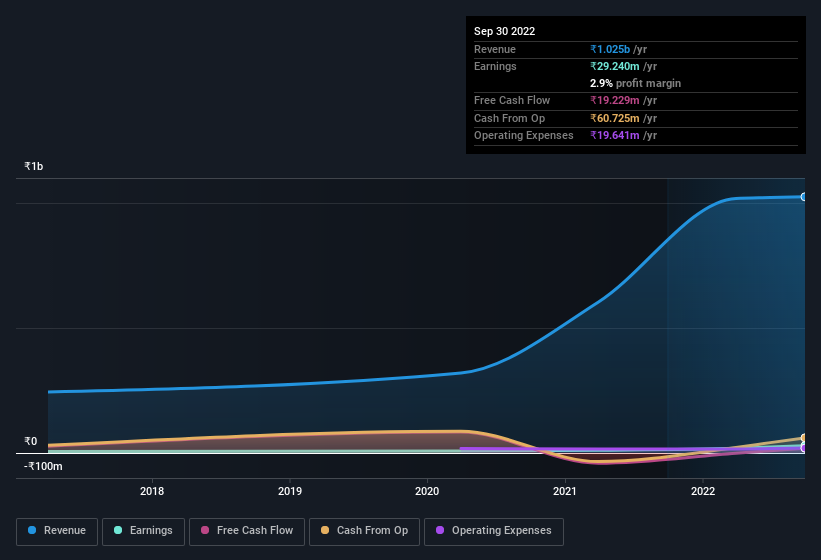

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Rex Pipes and Cables Industries reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Rex Pipes and Cables Industries is no giant, with a market capitalisation of ₹366m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Rex Pipes and Cables Industries Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Rex Pipes and Cables Industries insiders own a significant number of shares certainly is appealing. In fact, they own 61% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Although, with Rex Pipes and Cables Industries being valued at ₹366m, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to ₹223m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Rex Pipes and Cables Industries with market caps under ₹16b is about ₹3.5m.

The CEO of Rex Pipes and Cables Industries was paid just ₹1.2m in total compensation for the year ending March 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Rex Pipes and Cables Industries Deserve A Spot On Your Watchlist?

Rex Pipes and Cables Industries' earnings have taken off in quite an impressive fashion. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Rex Pipes and Cables Industries is certainly doing some things right and is well worth investigating. It is worth noting though that we have found 3 warning signs for Rex Pipes and Cables Industries (2 are significant!) that you need to take into consideration.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REXPIPES

Rex Pipes and Cables Industries

Manufactures and sells pipes and cable related accessories in India.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives