Do Rex Pipes and Cables Industries' (NSE:REXPIPES) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Rex Pipes and Cables Industries (NSE:REXPIPES). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Rex Pipes and Cables Industries

How Quickly Is Rex Pipes and Cables Industries Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Rex Pipes and Cables Industries' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 47%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

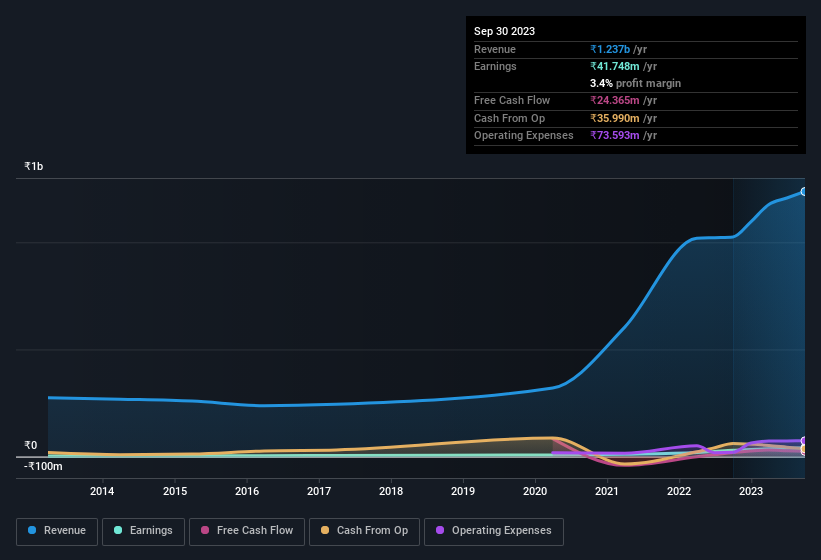

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Rex Pipes and Cables Industries remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 21% to ₹1.2b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Rex Pipes and Cables Industries isn't a huge company, given its market capitalisation of ₹559m. That makes it extra important to check on its balance sheet strength.

Are Rex Pipes and Cables Industries Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last twelve months Rex Pipes and Cables Industries insiders spent ₹1.9m on stock; good news for shareholders. While this investment may be modest, it is great considering the lack of insider selling. It is also worth noting that it was Non-Executive & Non Independent Director Jitendra Kaler who made the biggest single purchase, worth ₹954k, paying ₹68.14 per share.

It's reassuring that Rex Pipes and Cables Industries insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Namely, Rex Pipes and Cables Industries has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Rex Pipes and Cables Industries with market caps under ₹17b is about ₹3.5m.

The Rex Pipes and Cables Industries CEO received total compensation of only ₹1.4m in the year to March 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Rex Pipes and Cables Industries Worth Keeping An Eye On?

Rex Pipes and Cables Industries' earnings per share have been soaring, with growth rates sky high. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Rex Pipes and Cables Industries is at an inflection point, given the EPS growth. If so, then its potential for further gains probably merit a spot on your watchlist. You still need to take note of risks, for example - Rex Pipes and Cables Industries has 2 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Rex Pipes and Cables Industries, you'll probably love this curated collection of companies in IN that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REXPIPES

Rex Pipes and Cables Industries

Manufactures and sells pipes and cable related accessories in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.