- India

- /

- Trade Distributors

- /

- NSEI:REFEX

Do Refex Industries' (NSE:REFEX) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Refex Industries (NSE:REFEX). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Refex Industries with the means to add long-term value to shareholders.

View our latest analysis for Refex Industries

How Fast Is Refex Industries Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's no surprise that some investors are more inclined to invest in profitable businesses. In impressive fashion, Refex Industries' EPS grew from ₹18.14 to ₹31.70, over the previous 12 months. It's a rarity to see 75% year-on-year growth like that. The best case scenario? That the business has hit a true inflection point.

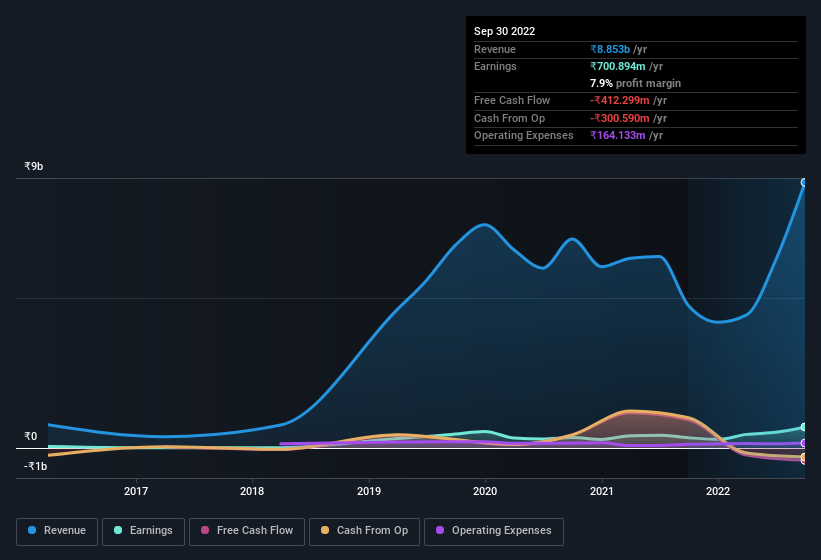

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Refex Industries achieved similar EBIT margins to last year, revenue grew by a solid 87% to ₹8.9b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Refex Industries is no giant, with a market capitalisation of ₹5.2b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Refex Industries Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Refex Industries top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Executive Chairman & MD, T. Jain, paid ₹7.3m to buy shares at an average price of ₹127. Purchases like this clue us in to the to the faith management has in the business' future.

Should You Add Refex Industries To Your Watchlist?

Refex Industries' earnings per share have been soaring, with growth rates sky high. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And may very well signal a significant inflection point for the business. If that's the case, you may regret neglecting to put Refex Industries on your watchlist. You still need to take note of risks, for example - Refex Industries has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Keen growth investors love to see insider buying. Thankfully, Refex Industries isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REFEX

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives