- India

- /

- Electrical

- /

- NSEI:PARACABLES

Increases to CEO Compensation Might Be Put On Hold For Now at Paramount Communications Limited (NSE:PARACABLES)

Key Insights

- Paramount Communications to hold its Annual General Meeting on 28th of September

- Salary of ₹16.0m is part of CEO Sanjay Aggarwal's total remuneration

- The overall pay is 35% above the industry average

- Over the past three years, Paramount Communications' EPS grew by 31% and over the past three years, the total shareholder return was 850%

CEO Sanjay Aggarwal has done a decent job of delivering relatively good performance at Paramount Communications Limited (NSE:PARACABLES) recently. As shareholders go into the upcoming AGM on 28th of September, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Paramount Communications

Comparing Paramount Communications Limited's CEO Compensation With The Industry

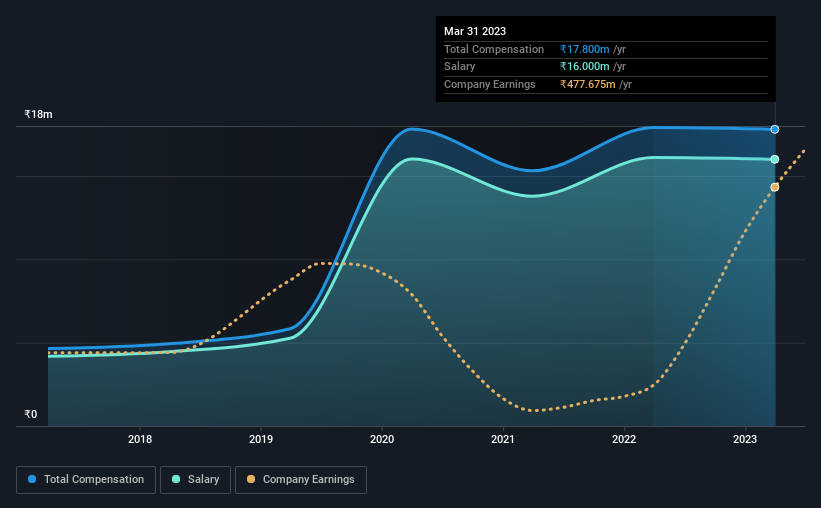

At the time of writing, our data shows that Paramount Communications Limited has a market capitalization of ₹16b, and reported total annual CEO compensation of ₹18m for the year to March 2023. That is, the compensation was roughly the same as last year. We note that the salary portion, which stands at ₹16.0m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Indian Electrical industry with market capitalizations ranging between ₹8.3b and ₹33b had a median total CEO compensation of ₹13m. Hence, we can conclude that Sanjay Aggarwal is remunerated higher than the industry median. What's more, Sanjay Aggarwal holds ₹2.8b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹16m | ₹16m | 90% |

| Other | ₹1.8m | ₹1.8m | 10% |

| Total Compensation | ₹18m | ₹18m | 100% |

On an industry level, around 85% of total compensation represents salary and 15% is other remuneration. Paramount Communications is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Paramount Communications Limited's Growth

Over the past three years, Paramount Communications Limited has seen its earnings per share (EPS) grow by 31% per year. In the last year, its revenue is up 30%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Paramount Communications Limited Been A Good Investment?

Most shareholders would probably be pleased with Paramount Communications Limited for providing a total return of 850% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Paramount Communications (1 is a bit unpleasant!) that you should be aware of before investing here.

Switching gears from Paramount Communications, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PARACABLES

Paramount Communications

Engages in the manufacture and sale of wires and cables to in India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives