- India

- /

- Construction

- /

- NSEI:OMINFRAL

Om Infra Limited (NSE:OMINFRAL) Stocks Shoot Up 31% But Its P/E Still Looks Reasonable

Om Infra Limited (NSE:OMINFRAL) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 36% in the last year.

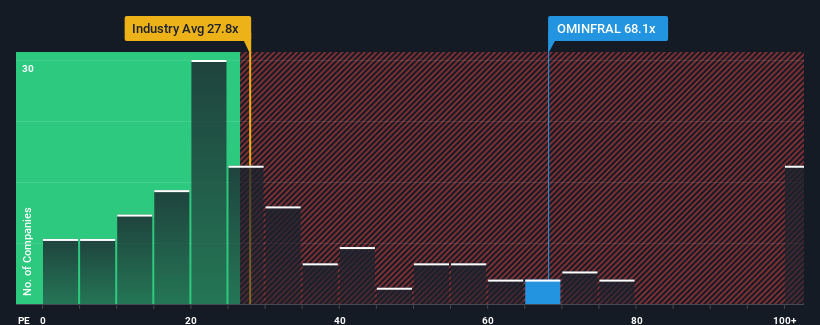

Since its price has surged higher, Om Infra may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 68.1x, since almost half of all companies in India have P/E ratios under 33x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For example, consider that Om Infra's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Om Infra

How Is Om Infra's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Om Infra's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 45%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 115% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 26% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Om Infra's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

The strong share price surge has got Om Infra's P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Om Infra maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Om Infra that you need to be mindful of.

If you're unsure about the strength of Om Infra's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OMINFRAL

Om Infra

Engages in the design, engineering, manufacture, supply, installation, testing, and commissioning of hydro mechanical equipment for hydroelectric power and irrigation projects in India and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives