Indo National Limited's (NSE:NIPPOBATRY) investors are due to receive a payment of ₹5.00 per share on 27th of October. Based on this payment, the dividend yield on the company's stock will be 1.2%, which is an attractive boost to shareholder returns.

Check out our latest analysis for Indo National

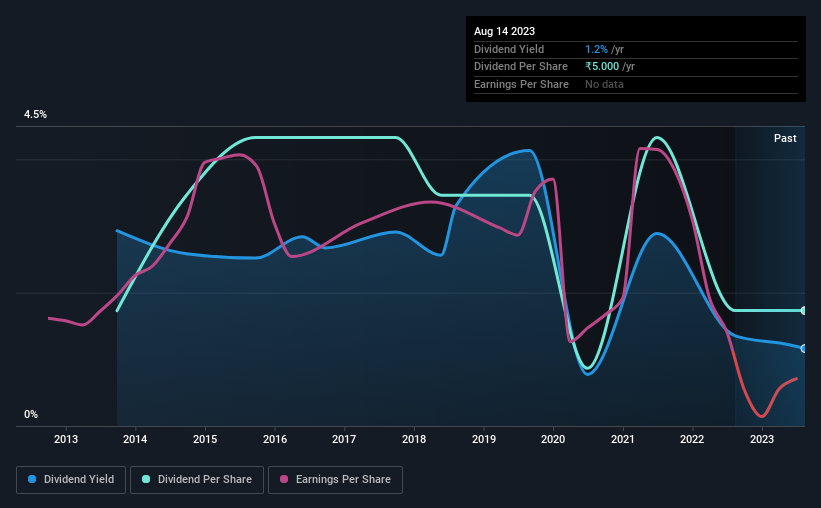

Indo National's Distributions May Be Difficult To Sustain

A big dividend yield for a few years doesn't mean much if it can't be sustained. While Indo National is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Over the next year, EPS might fall by 40.3% based on recent performance. This means that the company won't turn a profit over the next year, but with healthy cash flows at the moment the dividend could still be okay to continue.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The payments haven't really changed that much since 10 years ago. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings per share has been sinking by 40% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Indo National's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 5 warning signs for Indo National you should be aware of, and 2 of them are concerning. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NIPPOBATRY

Indo National

Manufactures and distributes dry cell batteries, rechargeable batteries, flashlights, and general lighting products in India.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives