- India

- /

- Construction

- /

- NSEI:NILAINFRA

Nila Infrastructures Limited (NSE:NILAINFRA) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Nila Infrastructures Limited (NSE:NILAINFRA) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 89%.

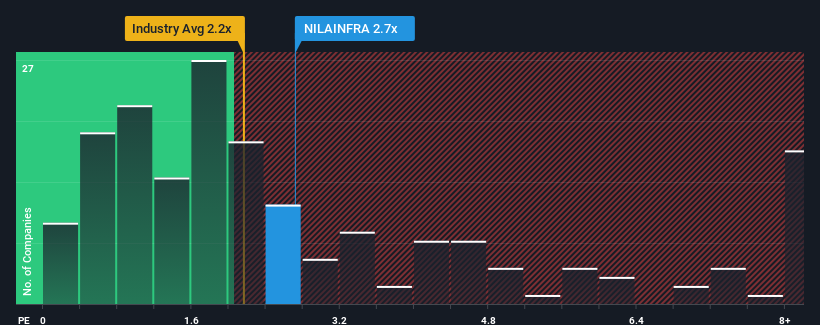

After such a large jump in price, when almost half of the companies in India's Construction industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Nila Infrastructures as a stock probably not worth researching with its 2.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Nila Infrastructures

What Does Nila Infrastructures' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Nila Infrastructures has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nila Infrastructures' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Nila Infrastructures?

The only time you'd be truly comfortable seeing a P/S as high as Nila Infrastructures' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 50% last year. Pleasingly, revenue has also lifted 91% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 14% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Nila Infrastructures' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

The large bounce in Nila Infrastructures' shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Nila Infrastructures maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Nila Infrastructures has 2 warning signs (and 1 which is potentially serious) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nila Infrastructures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NILAINFRA

Nila Infrastructures

Nila Infrastructures Limited constructs and develops infrastructure and real estate projects in India.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives