- India

- /

- Electrical

- /

- NSEI:UEL

Three Undiscovered Gems In India With Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 4.0%, yet it remains up 40% over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be crucial for investors seeking to capitalize on India's economic momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Yuken India | 27.52% | 9.91% | -52.98% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.07% | 13.43% | 5.94% | ★★★★★★ |

| NGL Fine-Chem | 12.35% | 15.70% | 9.76% | ★★★★★★ |

| AGI Infra | 61.29% | 29.69% | 35.60% | ★★★★★★ |

| Piccadily Agro Industries | 50.57% | 13.78% | 39.75% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| Genesys International | 10.57% | 13.38% | 27.53% | ★★★★★☆ |

| Share India Securities | 24.23% | 37.66% | 48.98% | ★★★★☆☆ |

| Master Trust | 37.05% | 26.63% | 41.10% | ★★★★☆☆ |

| SG Mart | 16.73% | 99.32% | 94.08% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Gokul Agro Resources (NSEI:GOKULAGRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gokul Agro Resources Limited manufactures and trades in edible and non-edible oils, meals, and other agro products in India with a market cap of ₹30.58 billion.

Operations: Gokul Agro Resources generates revenue primarily from agro-based commodities, amounting to ₹156.80 billion. The company focuses on manufacturing and trading various oils and meals within India.

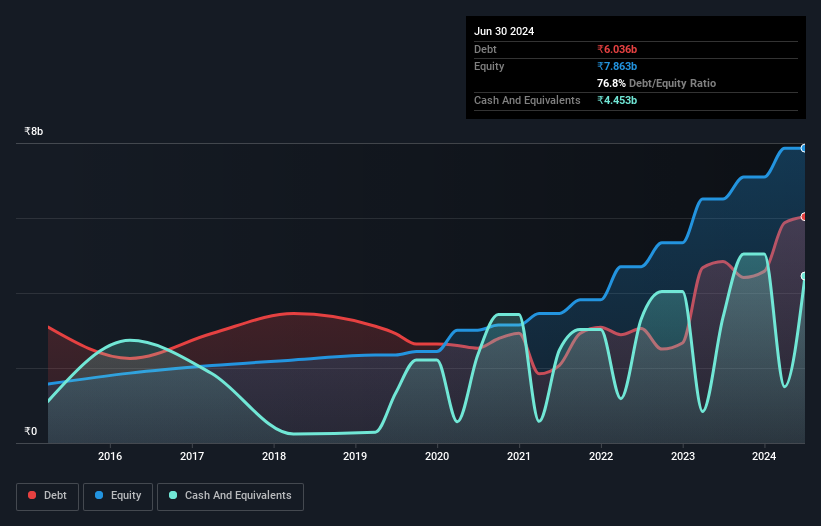

Gokul Agro Resources has shown impressive earnings growth of 28.4% over the past year, outpacing the Food industry’s 14.1%. The company’s net debt to equity ratio stands at a satisfactory 20.1%, reflecting prudent financial management. Despite a reduced debt to equity ratio from 124.4% to 76.8% over five years, interest coverage by EBIT remains low at 2.3x, indicating potential risks in servicing debt obligations. Recent Q1 results reported sales of ₹42,902M and net income of ₹528M, highlighting strong performance improvements compared to last year.

Marine Electricals (India) (NSEI:MARINE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Marine Electricals (India) Limited manufactures and sells various marine and industrial electrical and electronic components in India and internationally, with a market cap of ₹33.94 billion.

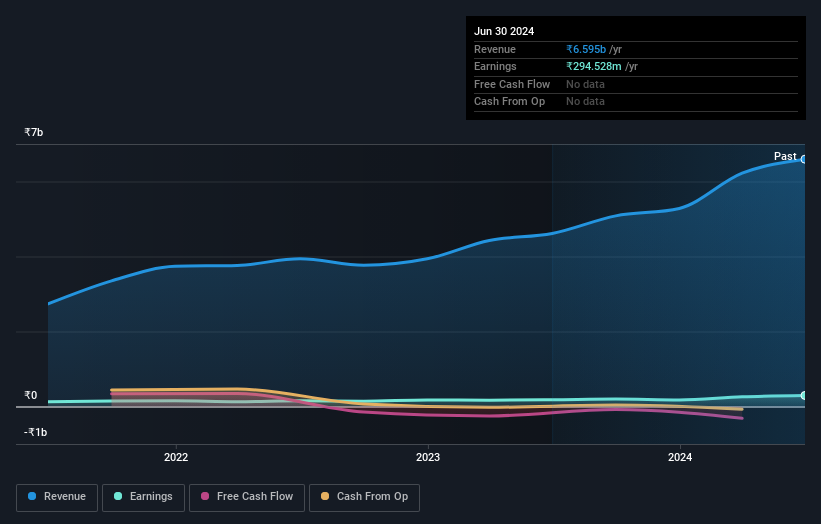

Operations: The company's revenue streams are derived from its marine segment, contributing ₹3.54 billion, and its industry segment, contributing ₹2.68 billion.

Marine Electricals (India) has shown impressive earnings growth of 52.4% over the past year, outpacing the electrical industry’s 29.1%. Recent orders include a significant INR 500 million contract from DC Development Hyderabad and an INR 204 million order from L&T Shipbuilding, indicating robust demand. Despite a slight increase in debt to equity ratio from 35.3% to 37.4% over five years, its net debt to equity ratio is satisfactory at 28.3%.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited focuses on the generation of solar power in India with a market cap of ₹38.81 billion.

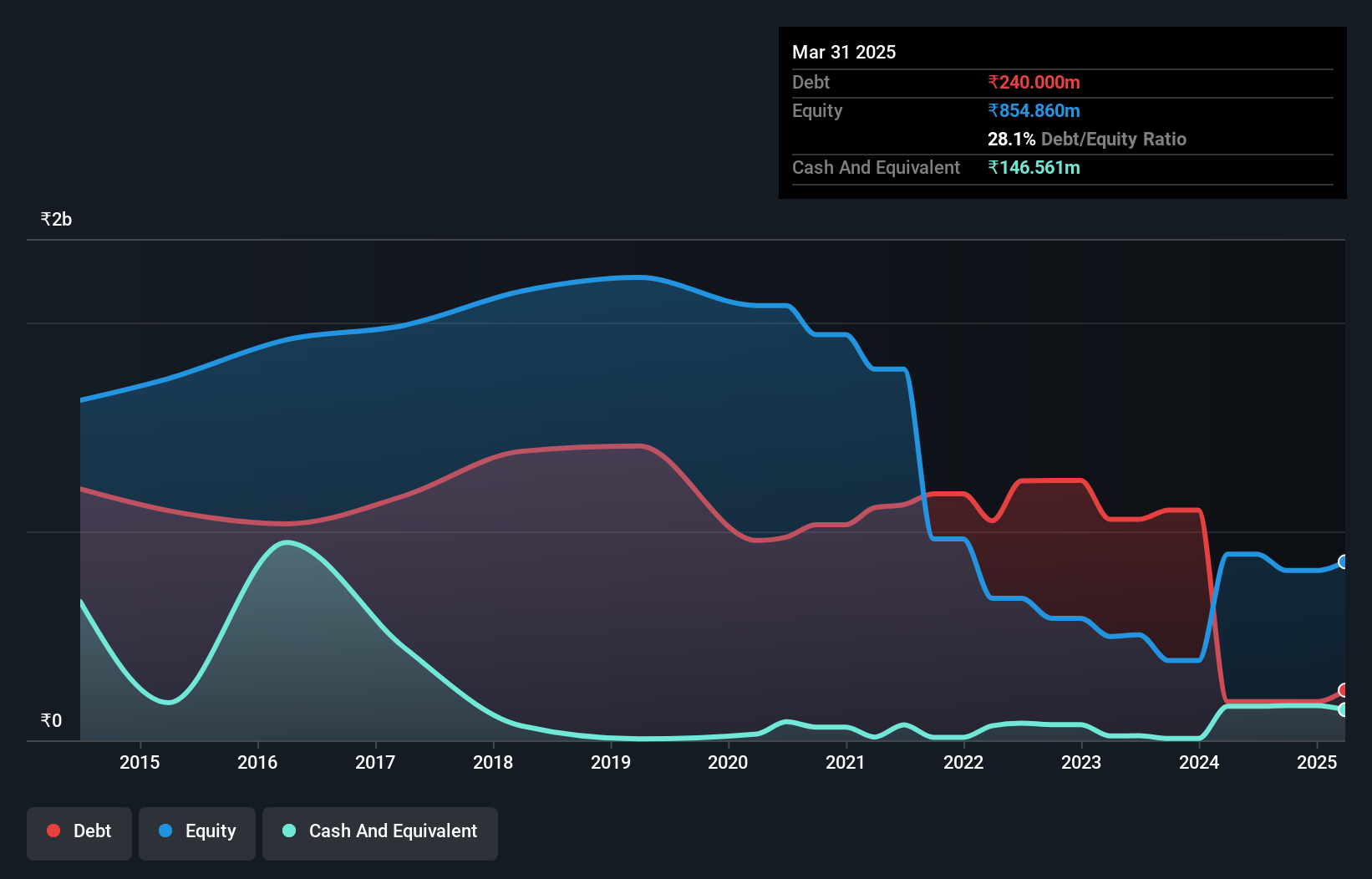

Operations: Ujaas Energy Limited generates revenue primarily from its Solar Power Plant Operation (₹297.31 million) and the Manufacturing and Sale of Solar Power Systems (₹172.52 million). The company also has a smaller revenue stream from EV-related activities amounting to ₹45.84 million.

Ujaas Energy, a small cap entity in the renewable energy sector, has shown notable financial dynamics recently. The company’s net debt to equity ratio stands at a satisfactory 2.5%, and it reported a significant turnaround with net income of ₹289.56M for the fiscal year ending March 2024, compared to a loss of ₹180.57M the previous year. However, its shares remain highly illiquid and were trading at 71.4% below estimated fair value as of recent assessments.

- Unlock comprehensive insights into our analysis of Ujaas Energy stock in this health report.

Explore historical data to track Ujaas Energy's performance over time in our Past section.

Taking Advantage

- Gain an insight into the universe of 460 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UEL

Flawless balance sheet slight.

Market Insights

Community Narratives