Here's Why We Think Lokesh Machines (NSE:LOKESHMACH) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Lokesh Machines (NSE:LOKESHMACH), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Lokesh Machines

How Quickly Is Lokesh Machines Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Lokesh Machines grew its EPS by 14% per year. That's a pretty good rate, if the company can sustain it.

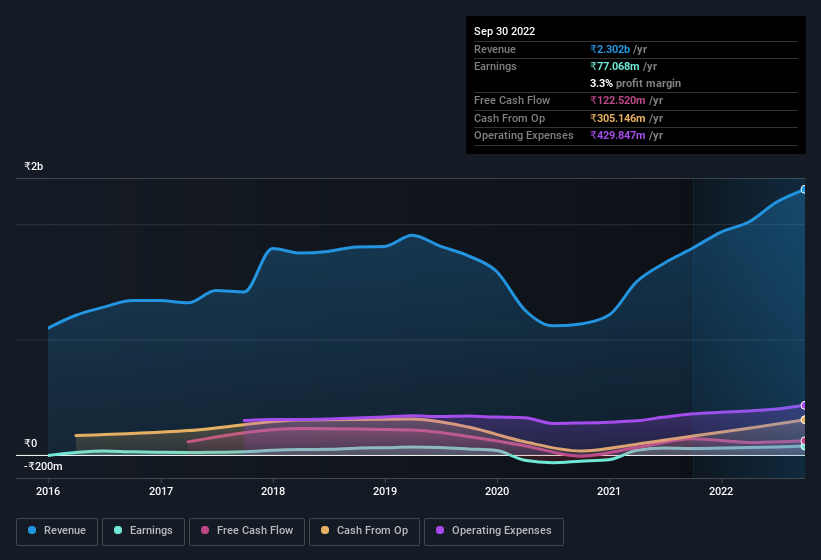

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Lokesh Machines achieved similar EBIT margins to last year, revenue grew by a solid 28% to ₹2.3b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Lokesh Machines is no giant, with a market capitalisation of ₹1.7b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Lokesh Machines Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Lokesh Machines insiders refrain from selling stock during the year, but they also spent ₹14m buying it. This is a good look for the company as it paints an optimistic picture for the future. We also note that it was the MD & Executive Director, Lokeswara Mullapudi, who made the biggest single acquisition, paying ₹3.5m for shares at about ₹76.90 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Lokesh Machines insiders own more than a third of the company. To be exact, company insiders hold 58% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Of course, Lokesh Machines is a very small company, with a market cap of only ₹1.7b. So despite a large proportional holding, insiders only have ₹974m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Should You Add Lokesh Machines To Your Watchlist?

One positive for Lokesh Machines is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. What about risks? Every company has them, and we've spotted 2 warning signs for Lokesh Machines (of which 1 can't be ignored!) you should know about.

Keen growth investors love to see insider buying. Thankfully, Lokesh Machines isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LOKESHMACH

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026