- India

- /

- Metals and Mining

- /

- NSEI:JAIBALAJI

Three Undiscovered Gems In India To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 3.2%, driven by gains in the Industrials and Financials sectors of 4.7% and 2.6%, respectively. With a market up 45% over the last 12 months and earnings forecast to grow by 16% annually, identifying stocks with strong fundamentals and growth potential can significantly enhance your investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | 3.93% | 3.59% | ★★★★★★ |

| Macpower CNC Machines | NA | 20.01% | 23.61% | ★★★★★★ |

| BLS E-Services | NA | 43.93% | 59.81% | ★★★★★★ |

| Le Travenues Technology | 8.99% | 36.48% | 63.83% | ★★★★★★ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Kalyani Investment | NA | 18.19% | 3.65% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.41% | 6.90% | 11.82% | ★★★★☆☆ |

| Apollo Micro Systems | 38.17% | 7.94% | 2.46% | ★★★★☆☆ |

| Rir Power Electronics | 53.98% | 13.52% | 31.41% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jai Balaji Industries (NSEI:JAIBALAJI)

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Balaji Industries Limited manufactures and markets iron and steel products primarily in India, with a market cap of ₹160.10 billion.

Operations: The company generates revenue primarily from its iron and steel products, amounting to ₹49.48 billion.

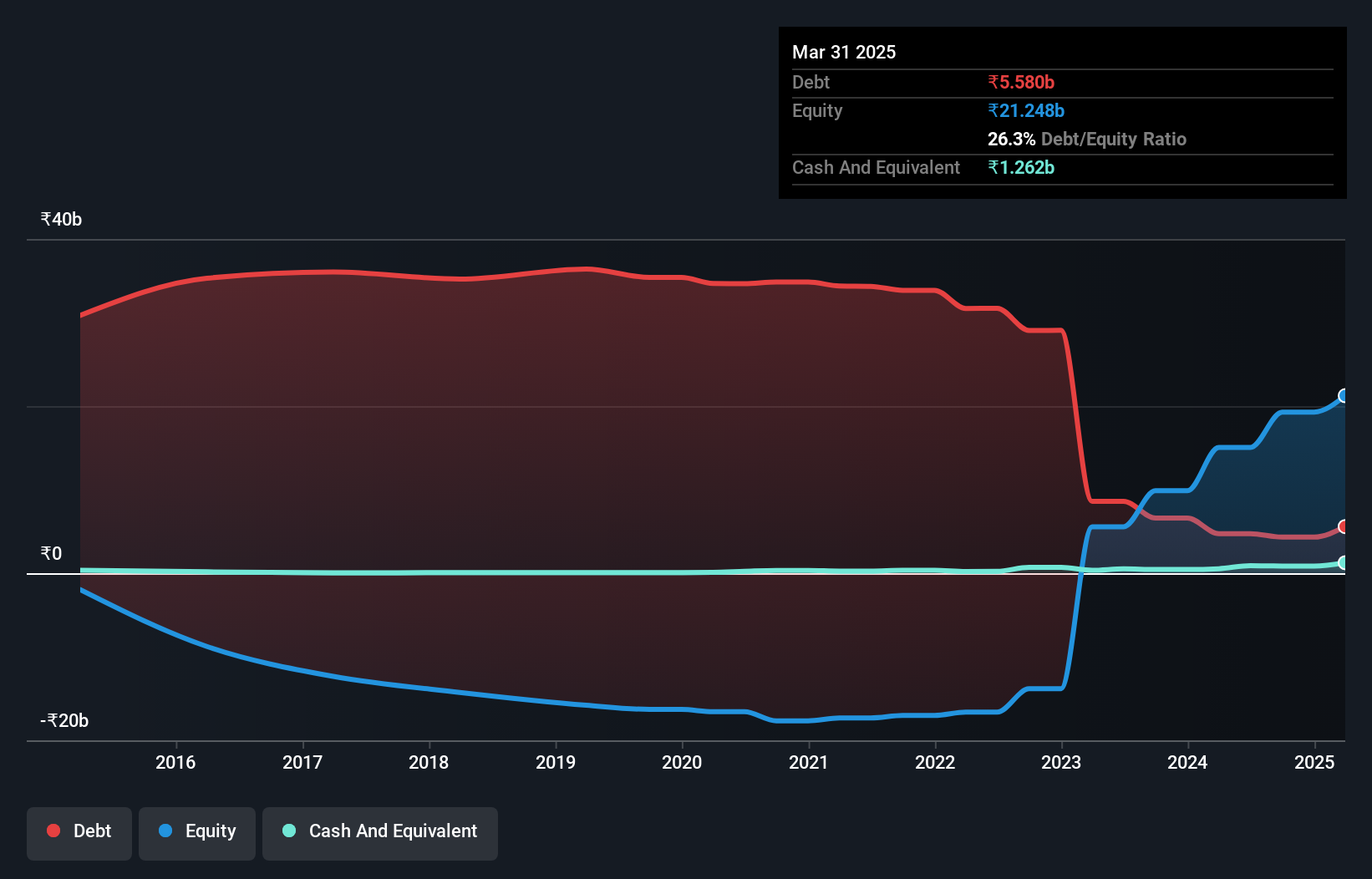

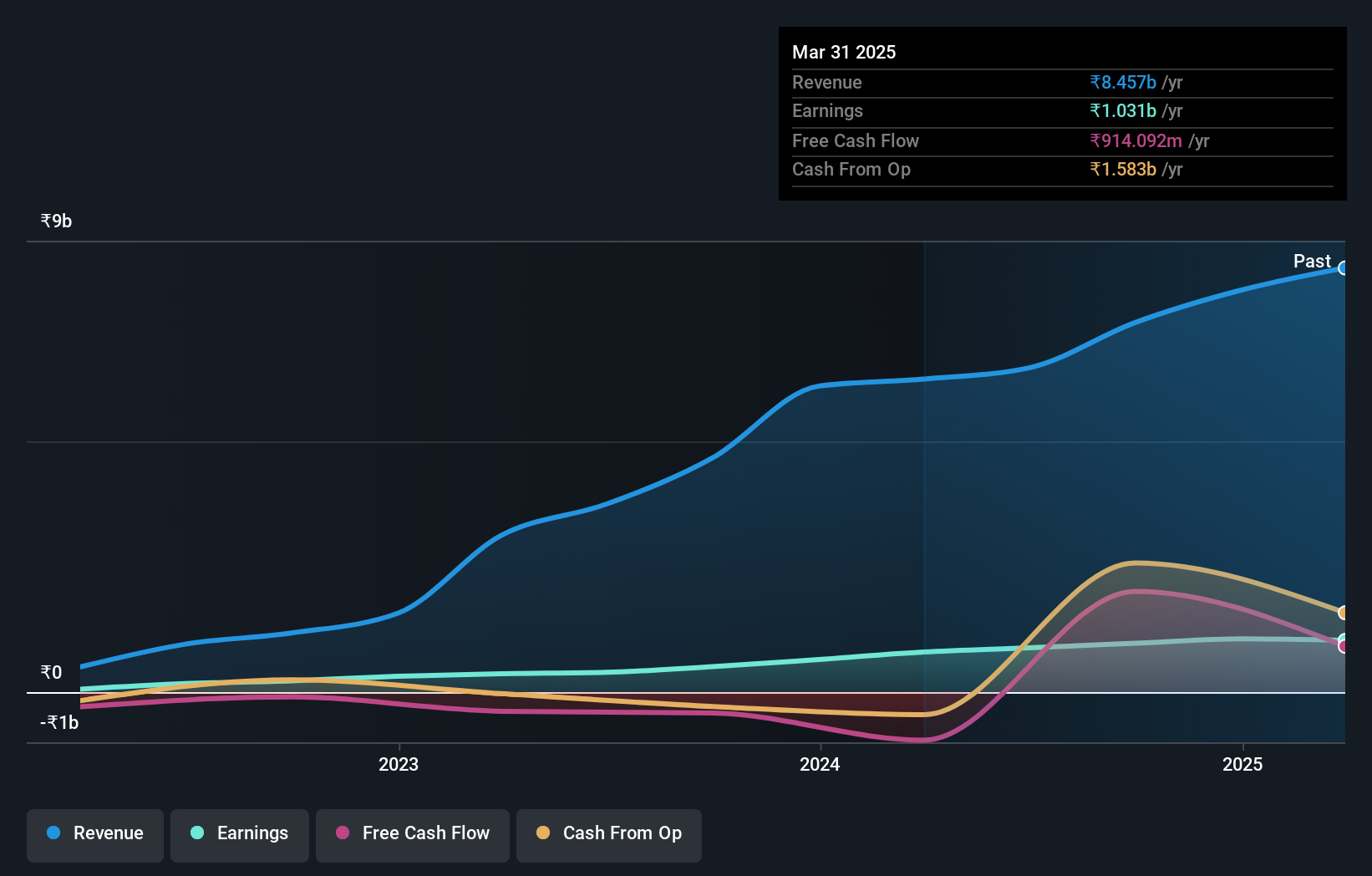

Jai Balaji Industries, a promising small cap in the Metals and Mining sector, has shown remarkable earnings growth of 244.5% over the past year, outpacing industry growth of 18.8%. The company's net debt to equity ratio stands at a satisfactory 25.4%, reflecting improved financial health from negative shareholder equity five years ago. With high-quality earnings and EBIT covering interest payments by 12.4 times, Jai Balaji's profitability is underscored by its recent quarterly net income of INR 20.88 million ($0.28 million).

- Click here to discover the nuances of Jai Balaji Industries with our detailed analytical health report.

Gain insights into Jai Balaji Industries' past trends and performance with our Past report.

Lloyds Engineering Works (NSEI:LLOYDSENGG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lloyds Engineering Works Limited provides engineering products and services in India with a market cap of ₹105.11 billion.

Operations: Lloyds Engineering Works generates revenue primarily from its engineering products and services segment, amounting to ₹6.24 billion.

Lloyds Engineering Works, a small-cap entity in the machinery sector, has seen its earnings grow by 116.8% over the past year, outpacing the industry’s 28.6%. Despite an increase in debt-to-equity ratio from 1.1% to 14.8% over five years, it holds more cash than total debt and covers interest payments comfortably. The company reported Q1 sales of INR 1,354 million with net income rising to INR 212 million compared to INR 128 million last year.

- Dive into the specifics of Lloyds Engineering Works here with our thorough health report.

Understand Lloyds Engineering Works' track record by examining our Past report.

Prudent Advisory Services (NSEI:PRUDENT)

Simply Wall St Value Rating: ★★★★★★

Overview: Prudent Corporate Advisory Services Limited offers advisory and distribution services for various mutual funds to individuals, corporates, high net worth individuals (HNIs), and ultra HNIs in India and internationally, with a market cap of ₹98.87 billion.

Operations: Prudent Corporate Advisory Services Limited generates revenue primarily from the distribution and sale of financial products, amounting to ₹8.23 billion. The company's market cap stands at ₹98.87 billion.

Prudent Advisory Services, a nimble player in India's financial advisory sector, reported revenue of INR 8.25 billion for FY2024, up from INR 6.19 billion the previous year. Net income stood at INR 1.39 billion compared to INR 1.17 billion last year, with basic earnings per share increasing to INR 33.51 from INR 28.18. The firm has no debt and its earnings have grown at an impressive annual rate of nearly 29% over the past five years, reflecting robust performance and strategic management decisions like the proposed amalgamation with Prudent Broking Services Private Limited likely boosting future prospects further.

- Click here and access our complete health analysis report to understand the dynamics of Prudent Advisory Services.

Learn about Prudent Advisory Services' historical performance.

Where To Now?

- Explore the 459 names from our Indian Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JAIBALAJI

Jai Balaji Industries

Manufactures and markets iron and steel products primarily in India.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026