With EPS Growth And More, Latteys Industries (NSE:LATTEYS) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Latteys Industries (NSE:LATTEYS), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Latteys Industries

Latteys Industries' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Latteys Industries' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 51%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

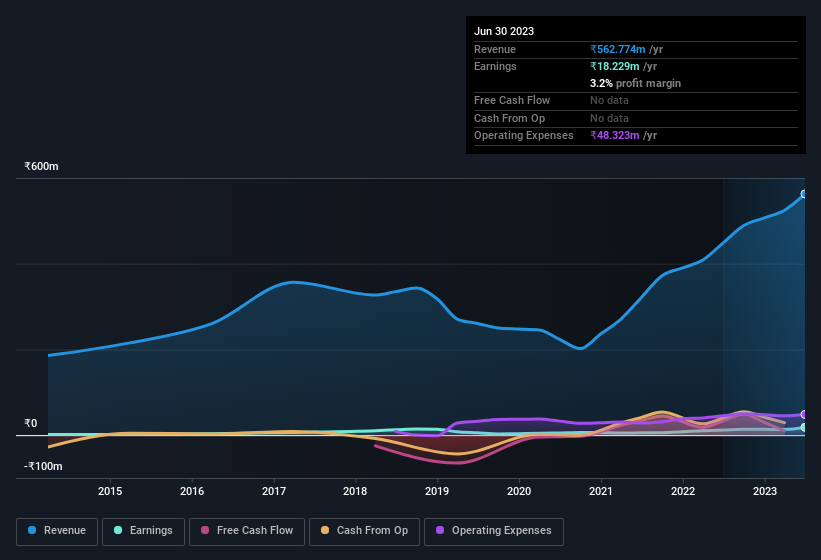

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Latteys Industries remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 25% to ₹563m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Latteys Industries isn't a huge company, given its market capitalisation of ₹2.2b. That makes it extra important to check on its balance sheet strength.

Are Latteys Industries Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that Latteys Industries insiders netted ₹910k worth of shares over the last year. On a brighter note, we see that Head of Marketing Department & Whole-Time Director Pawan Garg paid ₹1.6m for shares, at an average acquisition price of ₹6.55 per share. Overall, that is something good to take away.

On top of the insider buying, we can also see that Latteys Industries insiders own a large chunk of the company. In fact, they own 78% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. With that sort of holding, insiders have about ₹1.7b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Kapoor Garg is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Latteys Industries, with market caps under ₹17b is around ₹3.3m.

Latteys Industries' CEO only received compensation totalling ₹1.9m in the year to March 2022. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Latteys Industries Deserve A Spot On Your Watchlist?

Latteys Industries' earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Latteys Industries deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Latteys Industries (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Latteys Industries, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LATTEYS

Latteys Industries

Manufactures and sells water pumping solutions in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives