Investors Give Kriti Industries (India) Limited (NSE:KRITI) Shares A 28% Hiding

To the annoyance of some shareholders, Kriti Industries (India) Limited (NSE:KRITI) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

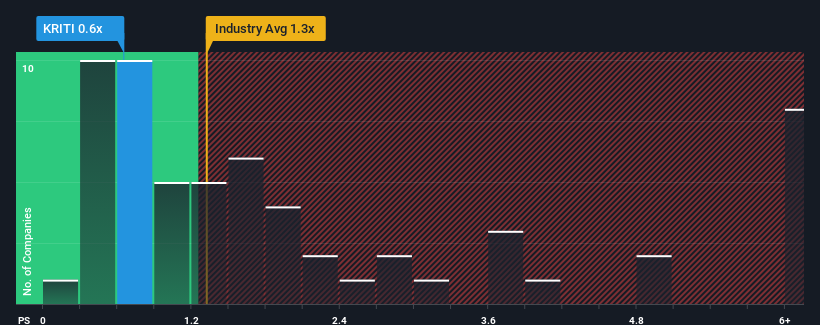

Even after such a large drop in price, when close to half the companies operating in India's Building industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Kriti Industries (India) as an enticing stock to check out with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Kriti Industries (India)

What Does Kriti Industries (India)'s Recent Performance Look Like?

As an illustration, revenue has deteriorated at Kriti Industries (India) over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kriti Industries (India)'s earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Kriti Industries (India)?

Kriti Industries (India)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.5%. Even so, admirably revenue has lifted 53% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that Kriti Industries (India)'s P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Kriti Industries (India)'s P/S?

Kriti Industries (India)'s P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kriti Industries (India) revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

You need to take note of risks, for example - Kriti Industries (India) has 4 warning signs (and 2 which are potentially serious) we think you should know about.

If you're unsure about the strength of Kriti Industries (India)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kriti Industries (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KRITI

Kriti Industries (India)

Manufactures and sells plastic products and pipes in India and internationally.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives