- India

- /

- Trade Distributors

- /

- NSEI:KOTHARIPRO

Here's Why Kothari Products (NSE:KOTHARIPRO) Can Afford Some Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Kothari Products Limited (NSE:KOTHARIPRO) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Kothari Products

What Is Kothari Products's Net Debt?

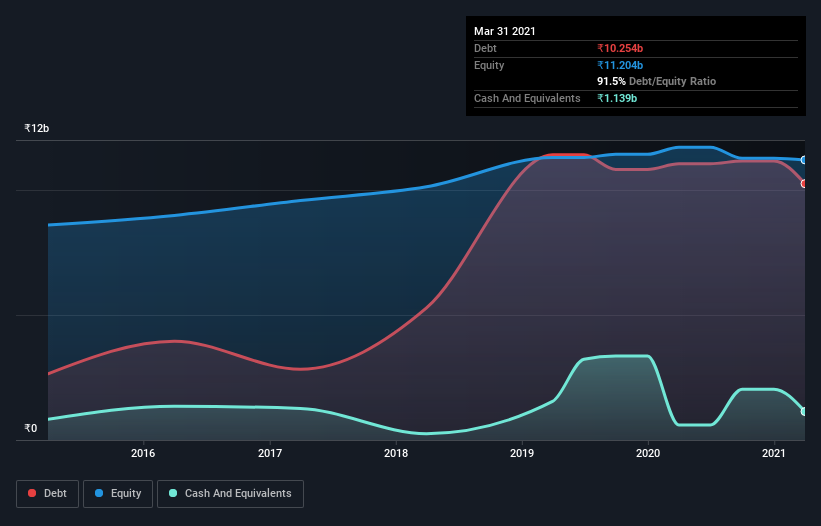

You can click the graphic below for the historical numbers, but it shows that Kothari Products had ₹10.3b of debt in March 2021, down from ₹11.0b, one year before. However, it also had ₹1.14b in cash, and so its net debt is ₹9.11b.

How Strong Is Kothari Products' Balance Sheet?

The latest balance sheet data shows that Kothari Products had liabilities of ₹10.8b due within a year, and liabilities of ₹4.10b falling due after that. On the other hand, it had cash of ₹1.14b and ₹20.5b worth of receivables due within a year. So it can boast ₹6.75b more liquid assets than total liabilities.

This surplus liquidity suggests that Kothari Products' balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. When analysing debt levels, the balance sheet is the obvious place to start. But it is Kothari Products's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Kothari Products had a loss before interest and tax, and actually shrunk its revenue by 24%, to ₹31b. That makes us nervous, to say the least.

Caveat Emptor

Not only did Kothari Products's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable ₹738m at the EBIT level. That said, we're impressed with the strong balance sheet liquidity. That should give the business time to grow its cashflow. While the stock is probably a bit risky, there may be an opportunity if the business itself improves, allowing the company to stage a recovery. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Kothari Products (including 2 which shouldn't be ignored) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Kothari Products or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kothari Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KOTHARIPRO

Kothari Products

Engages in international trade and real estate activities in India and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives