Downgrade: Here's How Analysts See Kirloskar Oil Engines Limited (NSE:KIRLOSENG) Performing In The Near Term

The analysts covering Kirloskar Oil Engines Limited (NSE:KIRLOSENG) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for next year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon. Surprisingly the share price has been buoyant, rising 13% to ₹652 in the past 7 days. Whether the downgrade will have a negative impact on demand for shares is yet to be seen.

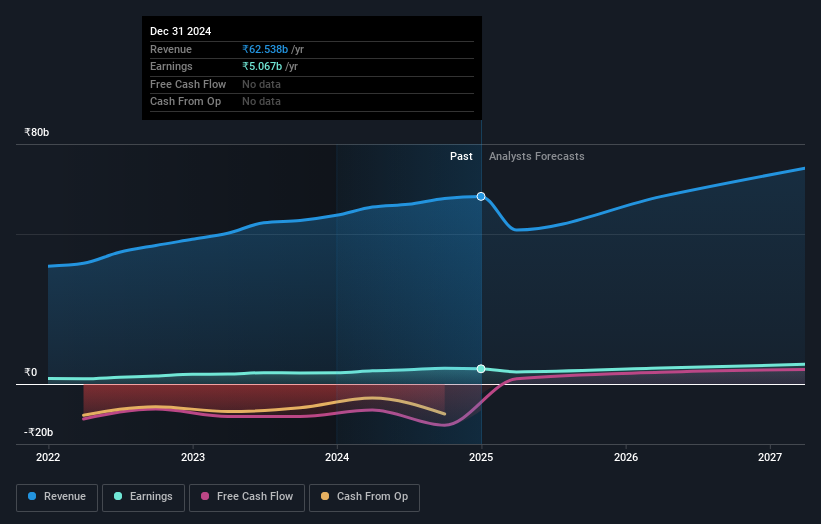

After the downgrade, the four analysts covering Kirloskar Oil Engines are now predicting revenues of ₹77b in 2026. If met, this would reflect a substantial 23% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to jump 20% to ₹41.90. Previously, the analysts had been modelling revenues of ₹87b and earnings per share (EPS) of ₹47.80 in 2026. Indeed, we can see that the analysts are a lot more bearish about Kirloskar Oil Engines' prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

Check out our latest analysis for Kirloskar Oil Engines

The consensus price target fell 5.9% to ₹1,328, with the weaker earnings outlook clearly leading analyst valuation estimates.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We can infer from the latest estimates that forecasts expect a continuation of Kirloskar Oil Engines'historical trends, as the 18% annualised revenue growth to the end of 2026 is roughly in line with the 16% annual revenue growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 13% annually. So it's pretty clear that Kirloskar Oil Engines is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. With a serious cut to next year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Kirloskar Oil Engines.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Kirloskar Oil Engines analysts - going out to 2027, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

If you're looking to trade Kirloskar Oil Engines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kirloskar Oil Engines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KIRLOSENG

Kirloskar Oil Engines

Manufactures and distributes diesel engines, agricultural pump sets, electric pump sets, power tillers, generating sets, and spares in India and internationally.

Solid track record and fair value.