Here's Why We Think Jupiter Wagons (NSE:JWL) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Jupiter Wagons (NSE:JWL), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Jupiter Wagons

Jupiter Wagons' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Jupiter Wagons to have grown EPS from ₹1.54 to ₹5.55 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

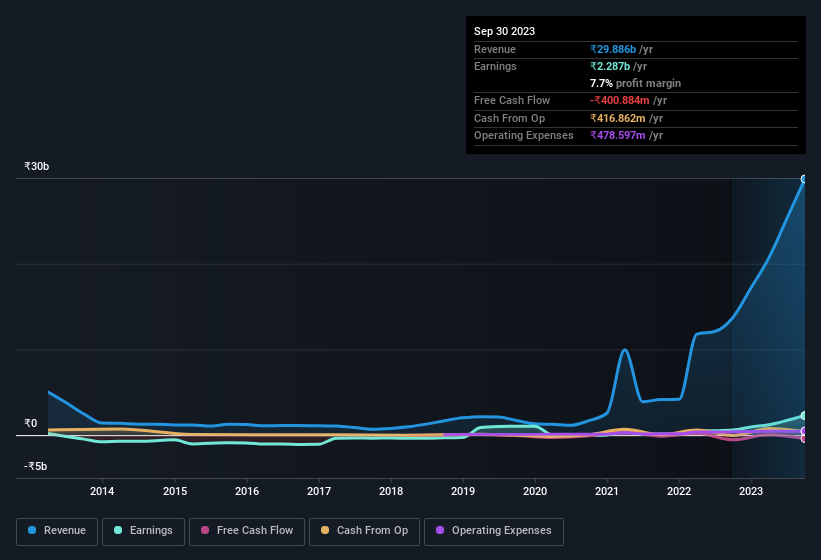

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Jupiter Wagons is growing revenues, and EBIT margins improved by 4.1 percentage points to 12%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Jupiter Wagons' forecast profits?

Are Jupiter Wagons Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Jupiter Wagons followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. We note that their impressive stake in the company is worth ₹15b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between ₹83b and ₹266b, like Jupiter Wagons, the median CEO pay is around ₹40m.

The Jupiter Wagons CEO received total compensation of just ₹10m in the year to March 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Jupiter Wagons Worth Keeping An Eye On?

Jupiter Wagons' earnings have taken off in quite an impressive fashion. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Jupiter Wagons certainly ticks a few boxes, so we think it's probably well worth further consideration. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jupiter Wagons (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Jupiter Wagons, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JWL

Jupiter Wagons

Manufactures and sells railway wagons, wagon components, and railway transportation equipment in India and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives