- India

- /

- Capital Markets

- /

- NSEI:SHAREINDIA

JNK India And Two More Undiscovered Gems With Potential

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, with a 2.3% increase over the last week and an impressive 45% rise over the past year. In this context of strong market performance and anticipated annual earnings growth of 16%, identifying stocks with untapped potential can be particularly rewarding for investors looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.07% | 13.43% | 5.94% | ★★★★★★ |

| AGI Infra | 61.29% | 29.69% | 35.60% | ★★★★★★ |

| Alembic | 0.42% | 11.74% | -6.39% | ★★★★★☆ |

| Focus Lighting and Fixtures | 4.44% | 24.11% | 67.92% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.78% | 39.75% | ★★★★★☆ |

| Genesys International | 10.57% | 13.38% | 27.53% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.07% | -10.66% | ★★★★★☆ |

| Sanstar | 50.30% | 37.73% | 58.24% | ★★★★☆☆ |

| Share India Securities | 23.33% | 37.66% | 48.98% | ★★★★☆☆ |

| SG Mart | 16.73% | 99.32% | 94.08% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

JNK India (NSEI:JNKINDIA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: JNK India Limited operates in the heating equipment industry, focusing on the design, engineering, manufacturing, supply, installation, and commissioning of various heating systems both in India and abroad with a market capitalization of ₹41.95 billion.

Operations: JNK India primarily generates revenue from the sale of fired heaters and related products, with a significant increase in net income from ₹164.76 million in 2021 to ₹626.49 million by mid-2024. The company's cost of goods sold (COGS) has escalated proportionally with revenue growth, reflecting higher operational activities over the years.

JNK India, a lesser-known yet promising entity within the machinery industry, has demonstrated robust growth and financial health. Over the past year, its earnings surged by 35.1%, outpacing industry growth of 28.6%. Impressively, future projections suggest an annual earnings increase of 31.8%. The company's net debt to equity ratio stands at a satisfactory 13.1%, reflecting prudent financial management. Recent significant orders from both domestic and international clients further underscore JNK India's expanding market presence and operational capabilities, positioning it as a compelling prospect in the Indian market landscape.

- Unlock comprehensive insights into our analysis of JNK India stock in this health report.

Examine JNK India's past performance report to understand how it has performed in the past.

Share India Securities (NSEI:SHAREINDIA)

Simply Wall St Value Rating: ★★★★☆☆

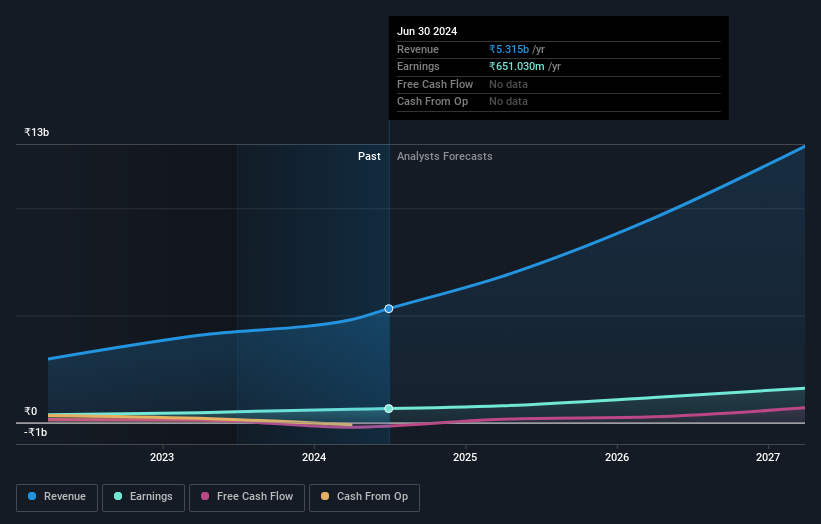

Overview: Share India Securities Limited is a financial services company in India with a market capitalization of ₹64.43 billion.

Operations: The company generates revenue primarily through its core operations, consistently achieving a high gross profit margin, which has been above 60% since 2022. Notably, the net income has shown substantial growth over the years, reaching ₹4.46 billion by mid-2024.

Share India Securities, a lesser-known yet promising entity in the Indian market, showcases robust financial health with earnings climbing 49% annually over five years. Despite not outpacing its industry's growth last year, it holds a P/E ratio of 14.4, well below the national average of 34.4. The firm has reduced its debt significantly, from a debt-to-equity ratio of 67.9% to 23.3%, enhancing its financial stability and appeal among prudent investors seeking untapped potential.

Vardhman Special Steels (NSEI:VSSL)

Simply Wall St Value Rating: ★★★★★★

Overview: Vardhman Special Steels Limited is a company engaged in the manufacturing and sale of billets, steel bars, and bright bars of various categories of special and alloy steels, serving both domestic and international markets with a market capitalization of ₹24.12 billion.

Operations: The company specializes in the manufacturing of steel products, generating a revenue of ₹16.67 billion as of the latest reporting period. It has demonstrated a notable gross profit margin improvement over time, with recent figures reaching approximately 36.23%.

Vardhman Special Steels, with a commendable net debt to equity ratio of 10.6%, showcases robust financial health. The firm's earnings have surged by 36.2% annually over the past five years, reflecting high-quality earnings and a strong market position below the industry average P/E of 34.5x at 24.3x. Recent figures from Q1 2024 affirm this trend, reporting a rise in net income to INR 260.78 million from INR 185.71 million year-over-year, alongside an increase in sales and revenue, underscoring its potential as an emerging gem in India’s steel sector.

- Click to explore a detailed breakdown of our findings in Vardhman Special Steels' health report.

Explore historical data to track Vardhman Special Steels' performance over time in our Past section.

Turning Ideas Into Actions

- Click this link to deep-dive into the 457 companies within our Indian Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SHAREINDIA

Share India Securities

Operates as a financial services company in India.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives