High Insider Ownership Growth Stocks On The Indian Exchange In July 2024

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, rising 2.3% in the last week and an impressive 45% over the past year, with earnings expected to grow by 16% annually. In this buoyant environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 34.4% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.5% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 20.9% | 31.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33% |

| Aether Industries (NSEI:AETHER) | 31.1% | 43.6% |

Let's uncover some gems from our specialized screener.

Astral (NSEI:ASTRAL)

Simply Wall St Growth Rating: ★★★★★☆

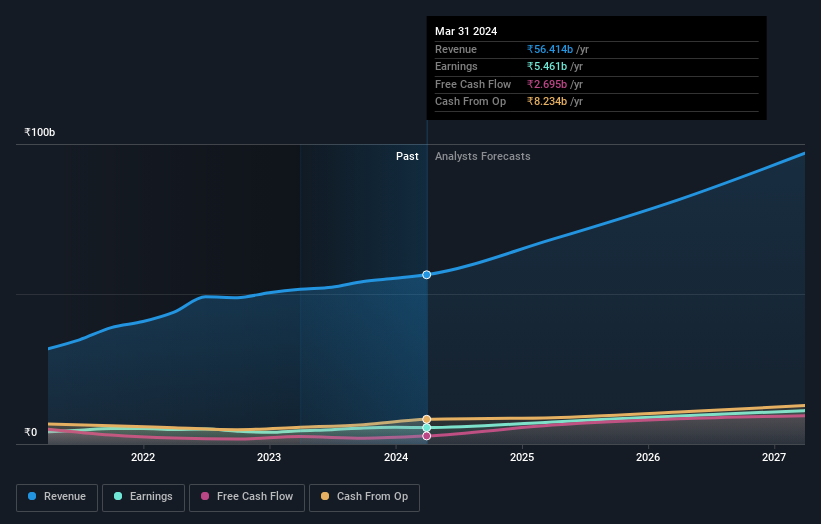

Overview: Astral Limited operates in the manufacturing and marketing of pipes, water tanks, and adhesives and sealants both in India and internationally, with a market capitalization of approximately ₹595.16 billion.

Operations: The company generates revenue primarily from two segments: plumbing, which contributes ₹41.42 billion, and paints and adhesives, accounting for ₹14.99 billion.

Insider Ownership: 39.4%

Earnings Growth Forecast: 23% p.a.

Astral has demonstrated consistent financial growth with a 19.1% increase in earnings over the past five years, and forecasts suggest a continued upward trajectory with earnings expected to grow by 23% annually. This growth outpaces the broader Indian market's average. Despite this robust performance, insider transactions have been mixed, with more shares sold than bought in recent months. Additionally, Astral's revenue growth forecast of 17.6% yearly is strong but falls short of the high-growth benchmark of 20%.

- Unlock comprehensive insights into our analysis of Astral stock in this growth report.

- According our valuation report, there's an indication that Astral's share price might be on the expensive side.

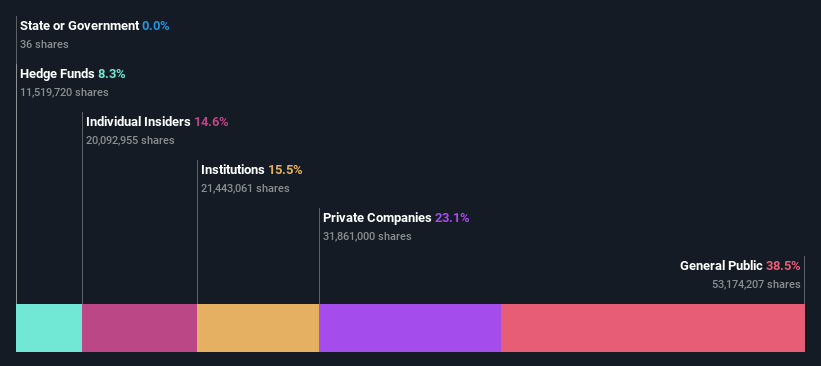

Intellect Design Arena (NSEI:INTELLECT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intellect Design Arena Limited specializes in developing software and providing services for the banking, insurance, and financial sectors across both domestic and international markets, with a market capitalization of approximately ₹137.88 billion.

Operations: The company generates ₹24.73 billion from its software product license and related services segment.

Insider Ownership: 14.7%

Earnings Growth Forecast: 22.9% p.a.

Intellect Design Arena has shown a robust earnings growth of 26.4% annually over the past five years, with future earnings expected to grow by 22.91% per year. Despite this strong performance, its revenue growth forecast at 10.8% yearly is modest compared to high-growth benchmarks. Recent insider activities show more buying than selling, albeit not in substantial volumes, indicating cautious optimism among insiders about the company's prospects. Additionally, Intellect's recent launch of iGPX and partnerships like with Vancity highlight its innovative strides and market expansion efforts.

- Click here to discover the nuances of Intellect Design Arena with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Intellect Design Arena is priced higher than what may be justified by its financials.

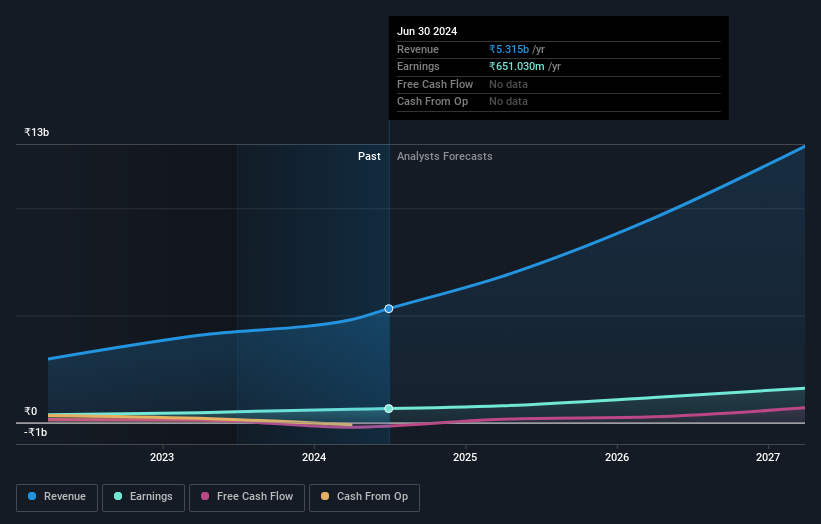

JNK India (NSEI:JNKINDIA)

Simply Wall St Growth Rating: ★★★★★★

Overview: JNK India Limited operates in the heating equipment sector, focusing on the design, engineering, manufacturing, supply, installation, and commissioning of process fired heaters, reformers, and cracking furnaces both in India and internationally with a market cap of ₹41.95 billion.

Operations: The company generates ₹4.80 billion in revenue from its fired heaters and related products segment.

Insider Ownership: 20.9%

Earnings Growth Forecast: 31.8% p.a.

JNK India is poised for substantial growth with earnings and revenue forecast to increase by 31.78% and 31.7% annually, outpacing the Indian market's average. The company recently secured significant orders, including from Reliance Industries for a project in Gujarat and JNK Global for a refinery project in the USA, enhancing its international presence. Despite its highly volatile share price recently, JNK India maintains a high Return on Equity forecast at 21.1%, signaling efficient management and profitability potential.

- Navigate through the intricacies of JNK India with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that JNK India's current price could be inflated.

Summing It All Up

- Take a closer look at our Fast Growing Indian Companies With High Insider Ownership list of 84 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JNKINDIA

JNK India

A heating equipment company, engages in designing, engineering, manufacturing, fabricating, procurement, erection, supplying, installing, and commissioning of process fired heaters, reformers, and cracking furnaces in India and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives