- India

- /

- Electrical

- /

- NSEI:INOXWIND

Market Participants Recognise Inox Wind Limited's (NSE:INOXWIND) Revenues Pushing Shares 38% Higher

Despite an already strong run, Inox Wind Limited (NSE:INOXWIND) shares have been powering on, with a gain of 38% in the last thirty days. This latest share price bounce rounds out a remarkable 477% gain over the last twelve months.

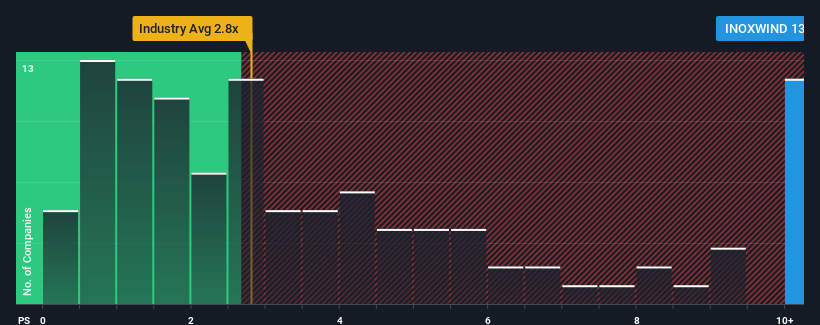

Following the firm bounce in price, given around half the companies in India's Electrical industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Inox Wind as a stock to avoid entirely with its 13.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Inox Wind

How Has Inox Wind Performed Recently?

Inox Wind certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Inox Wind will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Inox Wind?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Inox Wind's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 107% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 113% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 183% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 32%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Inox Wind's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Inox Wind's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Inox Wind shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Inox Wind that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Inox Wind, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INOXWIND

Inox Wind

Engages in the manufacture and sale of wind turbine generators and components for independent power producers, utilities, public sector undertakings, businesses, and private investors in India.

Exceptional growth potential with acceptable track record.