- India

- /

- Electrical

- /

- NSEI:INOXWIND

Investors push Inox Wind (NSE:INOXWIND) 10% lower this week, company's increasing losses might be to blame

The Inox Wind Limited (NSE:INOXWIND) share price has had a bad week, falling 10%. But that doesn't displace its brilliant performance over three years. The longer term view reveals that the share price is up 388% in that period. So the recent fall doesn't do much to dampen our respect for the business. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 10%, let's check if the fundamentals match the share price.

View our latest analysis for Inox Wind

Given that Inox Wind didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Inox Wind actually saw its revenue drop by 2.3% per year over three years. This is in stark contrast to the strong share price growth of 70%, compound, per year. This clear lack of correlation between revenue and share price is surprising to see in a money losing company. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

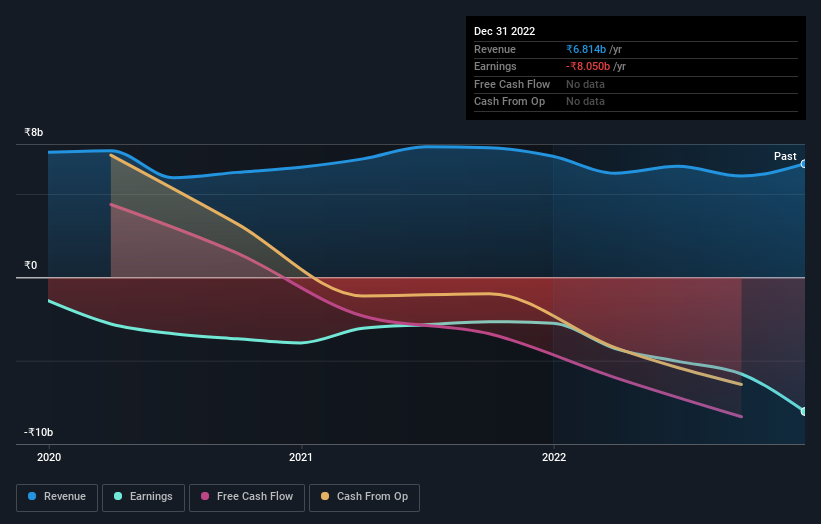

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 1.7% in the twelve months, Inox Wind shareholders did even worse, losing 6.2%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Inox Wind better, we need to consider many other factors. Take risks, for example - Inox Wind has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INOXWIND

Inox Wind

Engages in the manufacture and sale of wind turbine generators and components for independent power producers, utilities, public sector undertakings, businesses, and private investors in India.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives