- India

- /

- Construction

- /

- NSEI:HGINFRA

The total return for H.G. Infra Engineering (NSE:HGINFRA) investors has risen faster than earnings growth over the last five years

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the H.G. Infra Engineering Limited (NSE:HGINFRA) share price. It's 685% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. On the other hand, the stock price has retraced 4.5% in the last week. Anyone who held for that rewarding ride would probably be keen to talk about it.

In light of the stock dropping 4.5% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

View our latest analysis for H.G. Infra Engineering

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

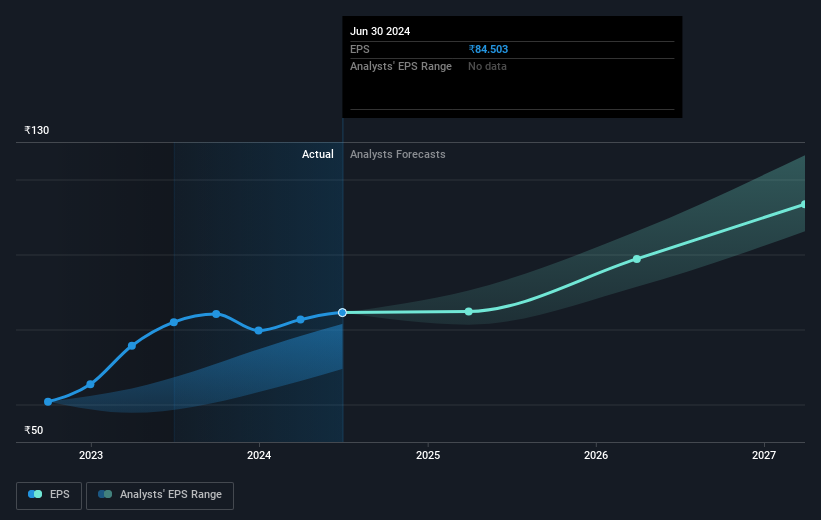

During five years of share price growth, H.G. Infra Engineering achieved compound earnings per share (EPS) growth of 32% per year. This EPS growth is slower than the share price growth of 51% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for H.G. Infra Engineering the TSR over the last 5 years was 690%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that H.G. Infra Engineering shareholders have received a total shareholder return of 51% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 51%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand H.G. Infra Engineering better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for H.G. Infra Engineering you should be aware of.

We will like H.G. Infra Engineering better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if H.G. Infra Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HGINFRA

H.G. Infra Engineering

Engages in the engineering, procurement, and construction (EPC) business in India.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026