- India

- /

- Construction

- /

- NSEI:HCC

With EPS Growth And More, Hindustan Construction (NSE:HCC) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Hindustan Construction (NSE:HCC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Hindustan Construction

How Quickly Is Hindustan Construction Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Hindustan Construction managed to grow EPS by 5.6% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

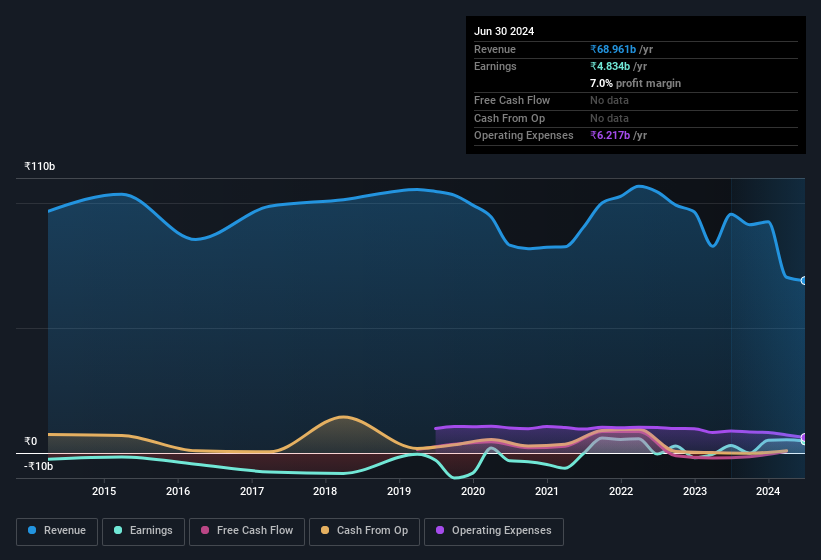

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Despite consistency in EBIT margins year on year, Hindustan Construction has actually recorded a dip in revenue. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Hindustan Construction's balance sheet strength, before getting too excited.

Are Hindustan Construction Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Hindustan Construction shares worth a considerable sum. Indeed, they hold ₹1.8b worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 2.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Hindustan Construction Deserve A Spot On Your Watchlist?

As previously touched on, Hindustan Construction is a growing business, which is encouraging. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. We should say that we've discovered 4 warning signs for Hindustan Construction (2 can't be ignored!) that you should be aware of before investing here.

Although Hindustan Construction certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HCC

Hindustan Construction

Provides engineering and construction services in India and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives