- India

- /

- Construction

- /

- NSEI:HCC

There Are Some Holes In Hindustan Construction's (NSE:HCC) Solid Earnings Release

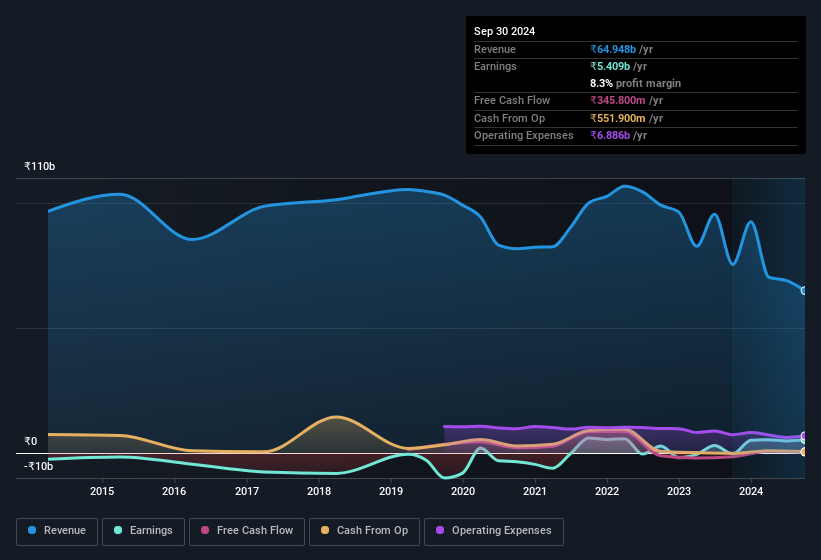

Investors appear disappointed with Hindustan Construction Company Limited's (NSE:HCC) recent earnings, despite the decent statutory profit number. Our analysis has found some underlying factors which may be cause for concern.

Check out our latest analysis for Hindustan Construction

A Closer Look At Hindustan Construction's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to September 2024, Hindustan Construction recorded an accrual ratio of 0.35. Unfortunately, that means its free cash flow was a lot less than its statutory profit, which makes us doubt the utility of profit as a guide. To wit, it produced free cash flow of ₹346m during the period, falling well short of its reported profit of ₹5.41b. Given that Hindustan Construction had negative free cash flow in the prior corresponding period, the trailing twelve month resul of ₹346m would seem to be a step in the right direction. Having said that, there is more to consider. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hindustan Construction.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Hindustan Construction issued 11% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Hindustan Construction's historical EPS growth by clicking on this link.

How Is Dilution Impacting Hindustan Construction's Earnings Per Share (EPS)?

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a bit of an impact on shareholders.

If Hindustan Construction's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Given the accrual ratio, it's not overly surprising that Hindustan Construction's profit was boosted by unusual items worth ₹9.1b in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Hindustan Construction had a rather significant contribution from unusual items relative to its profit to September 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Hindustan Construction's Profit Performance

In conclusion, Hindustan Construction's weak accrual ratio suggested its statutory earnings have been inflated by the unusual items. The dilution means the results are weaker when viewed from a per-share perspective. On reflection, the above-mentioned factors give us the strong impression that Hindustan Construction'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. If you want to do dive deeper into Hindustan Construction, you'd also look into what risks it is currently facing. To help with this, we've discovered 4 warning signs (2 shouldn't be ignored!) that you ought to be aware of before buying any shares in Hindustan Construction.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HCC

Hindustan Construction

Provides engineering and construction services in India and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives