- India

- /

- Electrical

- /

- NSEI:FOCUS

Here's Why We Think Focus Lighting and Fixtures (NSE:FOCUS) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Focus Lighting and Fixtures (NSE:FOCUS), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Focus Lighting and Fixtures with the means to add long-term value to shareholders.

View our latest analysis for Focus Lighting and Fixtures

Focus Lighting and Fixtures' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Focus Lighting and Fixtures has managed to grow EPS by 27% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

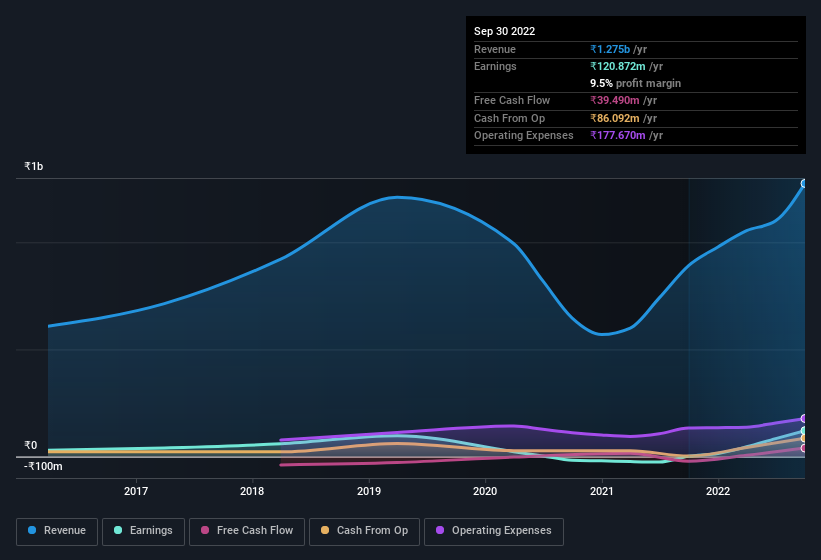

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Focus Lighting and Fixtures shareholders is that EBIT margins have grown from 1.2% to 12% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Focus Lighting and Fixtures isn't a huge company, given its market capitalisation of ₹3.1b. That makes it extra important to check on its balance sheet strength.

Are Focus Lighting and Fixtures Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Focus Lighting and Fixtures insiders own a meaningful share of the business. In fact, they own 67% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. To give you an idea, the value of insiders' holdings in the business are valued at ₹2.1b at the current share price. So there's plenty there to keep them focused!

Does Focus Lighting and Fixtures Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Focus Lighting and Fixtures' strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Focus Lighting and Fixtures' continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. We don't want to rain on the parade too much, but we did also find 3 warning signs for Focus Lighting and Fixtures (2 are significant!) that you need to be mindful of.

Although Focus Lighting and Fixtures certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FOCUS

Focus Lighting and Fixtures

Manufactures and deals in LED lighting, fixtures, and lighting solutions in India.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives