Electrosteel Castings Limited's (NSE:ELECTCAST) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

Electrosteel Castings Limited (NSE:ELECTCAST) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 267% in the last year.

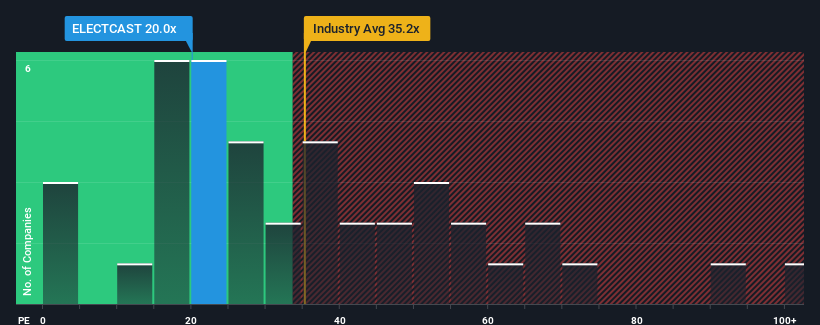

Although its price has surged higher, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 31x, you may still consider Electrosteel Castings as an attractive investment with its 20x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Electrosteel Castings' earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Electrosteel Castings

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Electrosteel Castings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 17%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings growth is heading into negative territory, declining 2.4% over the next year. That's not great when the rest of the market is expected to grow by 25%.

With this information, we are not surprised that Electrosteel Castings is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Electrosteel Castings' P/E

Electrosteel Castings' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Electrosteel Castings' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Electrosteel Castings you should know about.

If you're unsure about the strength of Electrosteel Castings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Electrosteel Castings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Electrosteel Castings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ELECTCAST

Electrosteel Castings

Manufactures and supplies ductile iron (DI) pipes, ductile iron fittings (DIF) and accessories, and cast iron (CI) pipes in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives