- India

- /

- Electrical

- /

- NSEI:ELECON

Some Elecon Engineering (NSE:ELECON) Shareholders Have Copped A Big 56% Share Price Drop

The nature of investing is that you win some, and you lose some. And unfortunately for Elecon Engineering Company Limited (NSE:ELECON) shareholders, the stock is a lot lower today than it was a year ago. To wit the share price is down 56% in that time. Even if you look out three years, the returns are still disappointing, with the share price down (the share price is down 48%) in that time. Furthermore, it's down 42% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for Elecon Engineering

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

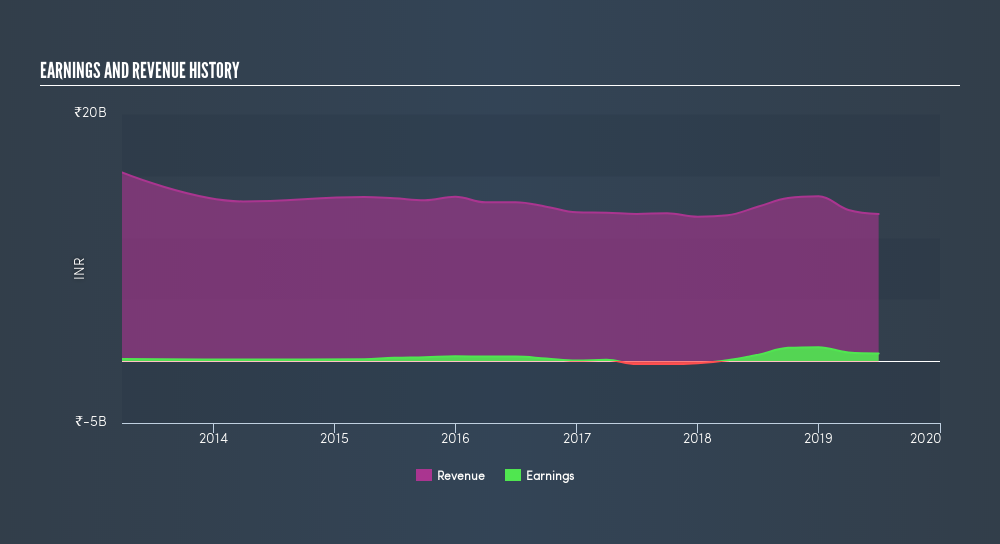

Even though the Elecon Engineering share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

With a low yield of 0.7% we doubt that the dividend influences the share price much. In contrast, the 4.7% drop in revenue is a real concern. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

This free interactive report on Elecon Engineering's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Elecon Engineering's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Elecon Engineering's TSR of was a loss of 56% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Elecon Engineering shareholders are down 56% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 11%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8.1% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is Elecon Engineering cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:ELECON

Elecon Engineering

Manufactures and sells power transmission and material handling equipment in India and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives