- India

- /

- Construction

- /

- NSEI:CCCL

Such Is Life: How Consolidated Construction Consortium Shareholders Saw Their Shares Drop 61%

The nature of investing is that you win some, and you lose some. And unfortunately for Consolidated Construction Consortium Limited (NSE:CCCL) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 61%. Even if you look out three years, the returns are still disappointing, with the share price down (the share price is down 58%) in that time. Furthermore, it's down 20% in about a quarter, which is even more concerning.

View our latest analysis for Consolidated Construction Consortium

Consolidated Construction Consortium isn't yet profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't yet make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Consolidated Construction Consortium's revenue didn't grow at all in the last year. In fact, it fell 20%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 61%. Having said that, if growth is coming in the future now may be the low ebb for the company. We have a natural aversion to companies that are losing money, not growing revenue, and losing favour with the market. But perhaps we shouldn't.

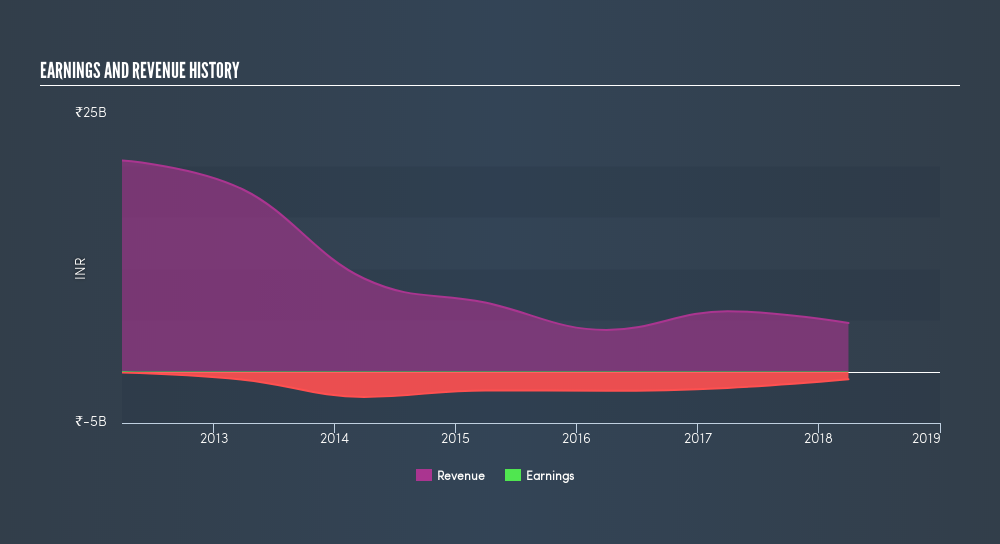

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at Consolidated Construction Consortium's financial health with this freereport on its balance sheet.

A Different Perspective

We regret to report that Consolidated Construction Consortium shareholders are down 61% for the year. Unfortunately, that's even worse than the broader market decline of 7.2%. Having said that, its inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.0% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Consolidated Construction Consortium's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:CCCL

Consolidated Construction Consortium

Engages in the provision of construction design, engineering, procurement, construction, and project management services in India and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives