- India

- /

- Construction

- /

- NSEI:CAPACITE

Capacit'e Infraprojects Limited's (NSE:CAPACITE) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Capacit'e Infraprojects' Annual General Meeting to take place on 26th of September

- CEO Rahul Katyal's total compensation includes salary of ₹20.4m

- The total compensation is 67% higher than the average for the industry

- Over the past three years, Capacit'e Infraprojects' EPS grew by 36% and over the past three years, the total shareholder return was 125%

Performance at Capacit'e Infraprojects Limited (NSE:CAPACITE) has been reasonably good and CEO Rahul Katyal has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 26th of September. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Capacit'e Infraprojects

How Does Total Compensation For Rahul Katyal Compare With Other Companies In The Industry?

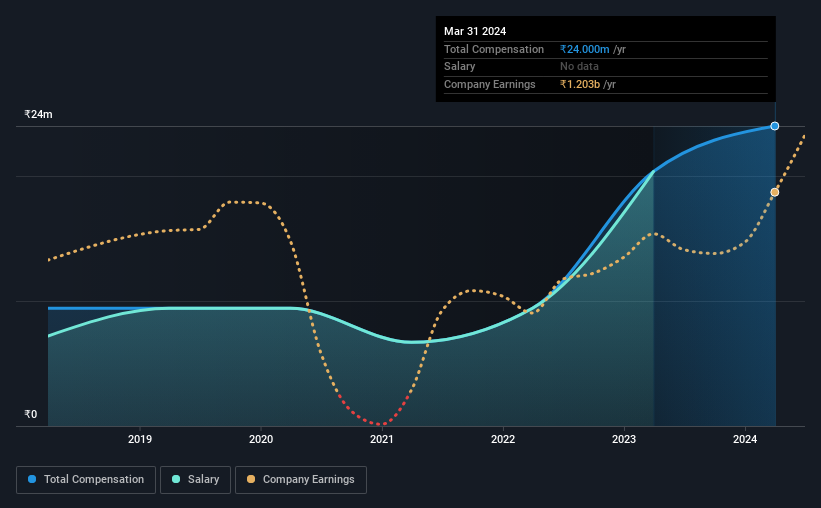

Our data indicates that Capacit'e Infraprojects Limited has a market capitalization of ₹33b, and total annual CEO compensation was reported as ₹24m for the year to March 2024. Notably, that's an increase of 18% over the year before. We note that the salary portion, which stands at ₹20.4m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Indian Construction industry with market capitalizations ranging between ₹17b and ₹67b had a median total CEO compensation of ₹14m. Hence, we can conclude that Rahul Katyal is remunerated higher than the industry median. Moreover, Rahul Katyal also holds ₹3.4b worth of Capacit'e Infraprojects stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹20m | ₹9.4m | 85% |

| Other | ₹3.6m | ₹11m | 15% |

| Total Compensation | ₹24m | ₹20m | 100% |

Speaking on an industry level, nearly 98% of total compensation represents salary, while the remainder of 2% is other remuneration. In Capacit'e Infraprojects' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Capacit'e Infraprojects Limited's Growth Numbers

Capacit'e Infraprojects Limited's earnings per share (EPS) grew 36% per year over the last three years. In the last year, its revenue is up 18%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Capacit'e Infraprojects Limited Been A Good Investment?

We think that the total shareholder return of 125%, over three years, would leave most Capacit'e Infraprojects Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Capacit'e Infraprojects that investors should be aware of in a dynamic business environment.

Switching gears from Capacit'e Infraprojects, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking to trade Capacit'e Infraprojects, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CAPACITE

Capacit'e Infraprojects

Engages in the engineering, procurement, and construction business in India.

Very undervalued with solid track record.