- India

- /

- Electrical

- /

- NSEI:BBL

Bharat Bijlee Limited (NSE:BBL) Stock Rockets 28% But Many Are Still Ignoring The Company

Despite an already strong run, Bharat Bijlee Limited (NSE:BBL) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 111% following the latest surge, making investors sit up and take notice.

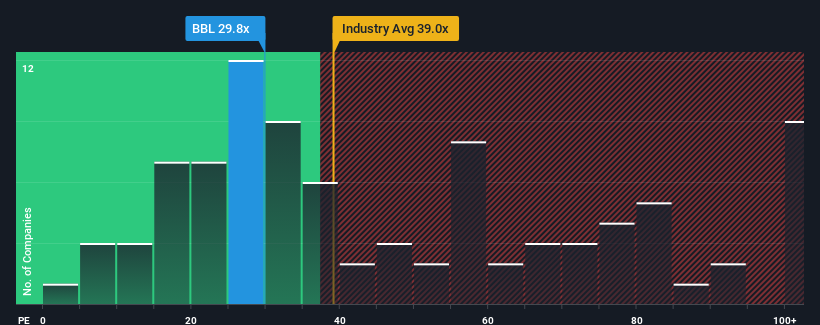

Even after such a large jump in price, it's still not a stretch to say that Bharat Bijlee's price-to-earnings (or "P/E") ratio of 29.8x right now seems quite "middle-of-the-road" compared to the market in India, where the median P/E ratio is around 31x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Bharat Bijlee certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Bharat Bijlee

How Is Bharat Bijlee's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Bharat Bijlee's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 61% gain to the company's bottom line. Pleasingly, EPS has also lifted 304% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Bharat Bijlee is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Bharat Bijlee's P/E

Bharat Bijlee's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Bharat Bijlee currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Bharat Bijlee.

If these risks are making you reconsider your opinion on Bharat Bijlee, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Bharat Bijlee, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bharat Bijlee might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BBL

Bharat Bijlee

Operates as an electrical engineering company in India and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives