- India

- /

- Industrials

- /

- NSEI:BALMLAWRIE

We Discuss Why Balmer Lawrie & Co. Ltd.'s (NSE:BALMLAWRIE) CEO May Deserve A Higher Pay Packet

Shareholders will probably not be disappointed by the robust results at Balmer Lawrie & Co. Ltd. (NSE:BALMLAWRIE) recently and they will be keeping this in mind as they go into the AGM on 27 September 2022. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

See our latest analysis for Balmer Lawrie

Comparing Balmer Lawrie & Co. Ltd.'s CEO Compensation With The Industry

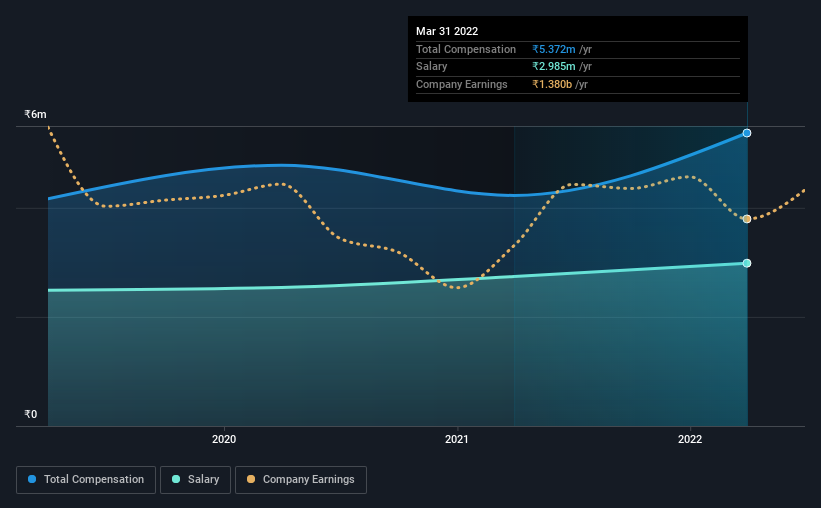

Our data indicates that Balmer Lawrie & Co. Ltd. has a market capitalization of ₹20b, and total annual CEO compensation was reported as ₹5.4m for the year to March 2022. We note that's an increase of 27% above last year. Notably, the salary which is ₹2.98m, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from ₹8.0b to ₹32b, the reported median CEO total compensation was ₹11m. Accordingly, Balmer Lawrie pays its CEO under the industry median.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹3.0m | ₹2.7m | 56% |

| Other | ₹2.4m | ₹1.5m | 44% |

| Total Compensation | ₹5.4m | ₹4.2m | 100% |

On an industry level, around 72% of total compensation represents salary and 28% is other remuneration. Balmer Lawrie sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Balmer Lawrie & Co. Ltd.'s Growth

Balmer Lawrie & Co. Ltd.'s earnings per share (EPS) grew 3.0% per year over the last three years. Its revenue is up 28% over the last year.

We like the look of the strong year-on-year improvement in revenue. Combined with modest EPS growth, we get a good impression of the company. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Balmer Lawrie & Co. Ltd. Been A Good Investment?

With a total shareholder return of 19% over three years, Balmer Lawrie & Co. Ltd. shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for Balmer Lawrie (1 is a bit concerning!) that you should be aware of before investing here.

Switching gears from Balmer Lawrie, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking to trade Balmer Lawrie, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Balmer Lawrie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BALMLAWRIE

Balmer Lawrie

Engages in industrial packaging, greases and lubricants, chemicals, logistic services and infrastructure, refinery and oil field, and travel and vacation services businesses in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives