Atam Valves Limited (NSE:ATAM) Might Not Be As Mispriced As It Looks

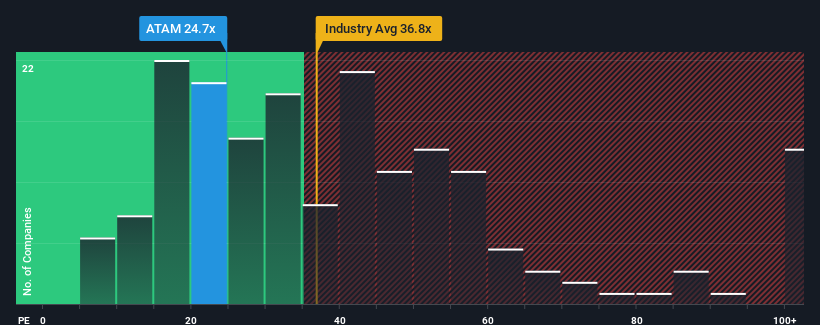

With a price-to-earnings (or "P/E") ratio of 24.7x Atam Valves Limited (NSE:ATAM) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 32x and even P/E's higher than 60x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Atam Valves' receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Atam Valves

Is There Any Growth For Atam Valves?

The only time you'd be truly comfortable seeing a P/E as low as Atam Valves' is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 31%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 291% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Atam Valves is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Atam Valves revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Atam Valves, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Atam Valves, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ATAM

Atam Valves

Manufactures and sells valves, fittings, steam traps, and strainers in India, Nepal, Indonesia, South Africa, Dubai, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives