Asian Granito India's (NSE:ASIANTILES) five-year decline in earnings translates into losses for shareholders

This week we saw the Asian Granito India Limited (NSE:ASIANTILES) share price climb by 17%. But if you look at the last five years the returns have not been good. After all, the share price is down 59% in that time, significantly under-performing the market.

On a more encouraging note the company has added ₹1.1b to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Our free stock report includes 4 warning signs investors should be aware of before investing in Asian Granito India. Read for free now.While Asian Granito India made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over five years, Asian Granito India grew its revenue at 6.2% per year. That's a fairly respectable growth rate. The share price return isn't so respectable with an annual loss of 10% over the period. That suggests the market is disappointed with the current growth rate. A pessimistic market can create opportunities.

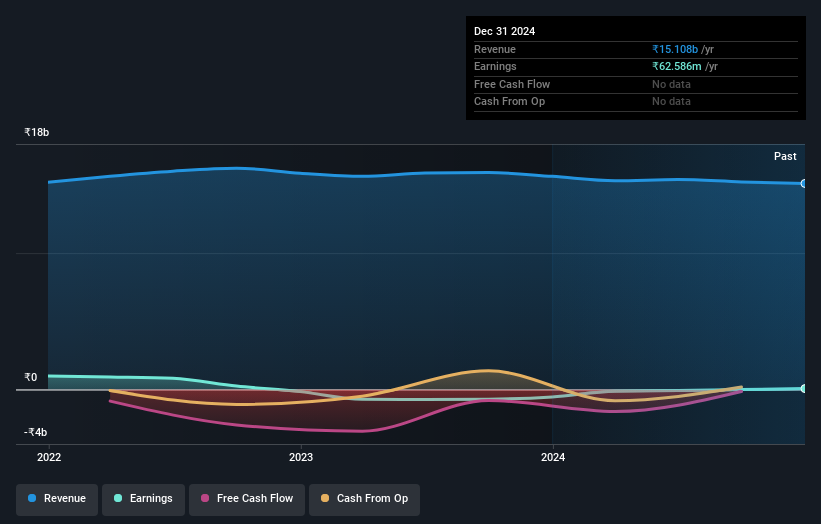

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered Asian Granito India's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Asian Granito India's TSR, which was a 34% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Asian Granito India shareholders are down 20% for the year, but the market itself is up 6.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Asian Granito India better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with Asian Granito India (including 1 which is a bit unpleasant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASIANTILES

Asian Granito India

Engages in the manufacture and trade of tiles, marbles, and related products in India.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives