I Ran A Stock Scan For Earnings Growth And ICICI Bank (NSE:ICICIBANK) Passed With Ease

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like ICICI Bank (NSE:ICICIBANK), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for ICICI Bank

How Quickly Is ICICI Bank Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. I, for one, am blown away by the fact that ICICI Bank has grown EPS by 59% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

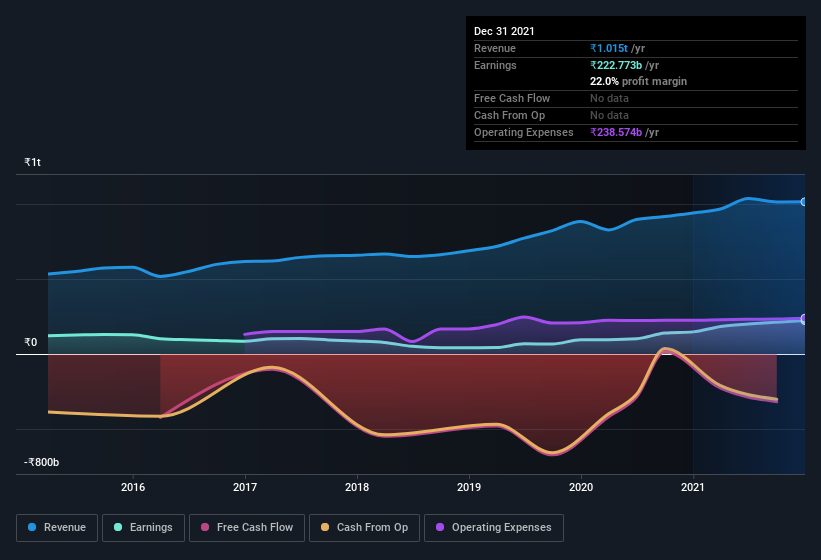

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of ICICI Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. ICICI Bank maintained stable EBIT margins over the last year, all while growing revenue 7.9% to ₹1.0t. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of ICICI Bank's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are ICICI Bank Insiders Aligned With All Shareholders?

Since ICICI Bank has a market capitalization of ₹5.2t, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Notably, they have an enormous stake in the company, worth ₹12b. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like ICICI Bank, with market caps over ₹600b, is about ₹86m.

The ICICI Bank CEO received total compensation of only ₹3.8m in the year to . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does ICICI Bank Deserve A Spot On Your Watchlist?

ICICI Bank's earnings per share have taken off like a rocket aimed right at the moon. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so I do think ICICI Bank is worth considering carefully. Of course, just because ICICI Bank is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade ICICI Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ICICIBANK

ICICI Bank

Engages in the provision of various banking and financial services to retail and corporate customers in India and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives