Here's Why We Think ICICI Bank (NSE:ICICIBANK) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in ICICI Bank (NSE:ICICIBANK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide ICICI Bank with the means to add long-term value to shareholders.

Check out our latest analysis for ICICI Bank

How Quickly Is ICICI Bank Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that ICICI Bank has managed to grow EPS by 30% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

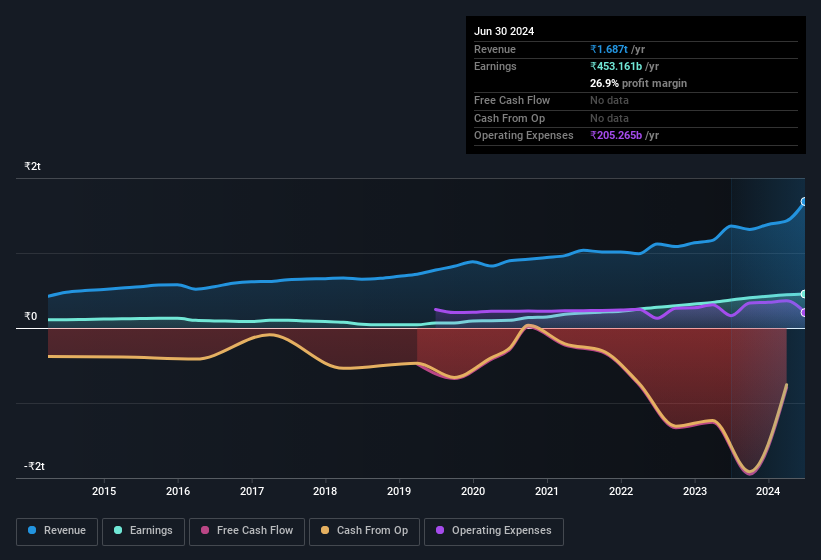

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that ICICI Bank's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for ICICI Bank remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 24% to ₹1.7t. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for ICICI Bank?

Are ICICI Bank Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ₹9.4t company like ICICI Bank. But we are reassured by the fact they have invested in the company. As a matter of fact, their holding is valued at ₹4.0b. That's a lot of money, and no small incentive to work hard. Despite being just 0.04% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is ICICI Bank Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into ICICI Bank's strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. What about risks? Every company has them, and we've spotted 1 warning sign for ICICI Bank you should know about.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade ICICI Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ICICIBANK

ICICI Bank

Engages in the provision of various banking and financial services to retail and corporate customers in India and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives