- India

- /

- Auto Components

- /

- NSEI:ZFCVINDIA

ZF Commercial Vehicle Control Systems India Limited's (NSE:ZFCVINDIA) CEO Looks Like They Deserve Their Pay Packet

Key Insights

- ZF Commercial Vehicle Control Systems India's Annual General Meeting to take place on 22nd of July

- CEO Periakaruppa Kaniappan's total compensation includes salary of ₹25.3m

- Total compensation is similar to the industry average

- ZF Commercial Vehicle Control Systems India's EPS grew by 58% over the past three years while total shareholder return over the past three years was 115%

The performance at ZF Commercial Vehicle Control Systems India Limited (NSE:ZFCVINDIA) has been quite strong recently and CEO Periakaruppa Kaniappan has played a role in it. Coming up to the next AGM on 22nd of July, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for ZF Commercial Vehicle Control Systems India

Comparing ZF Commercial Vehicle Control Systems India Limited's CEO Compensation With The Industry

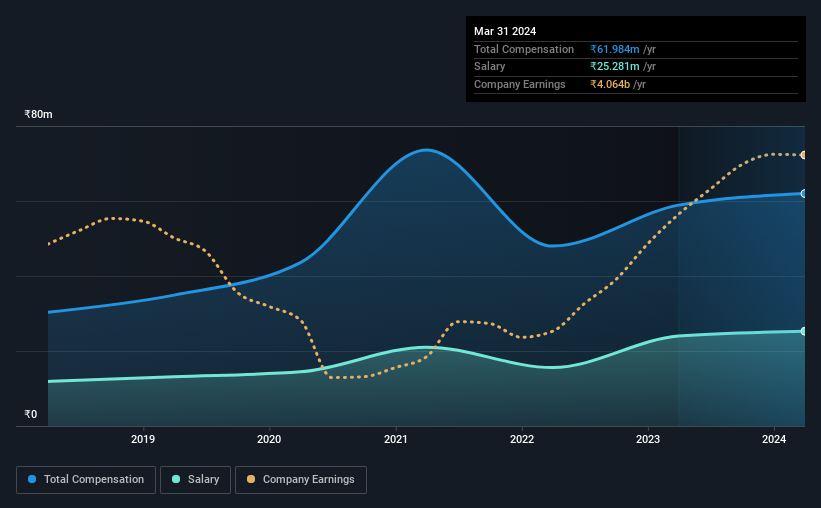

According to our data, ZF Commercial Vehicle Control Systems India Limited has a market capitalization of ₹301b, and paid its CEO total annual compensation worth ₹62m over the year to March 2024. That's a fairly small increase of 5.2% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹25m.

On comparing similar companies from the Indian Auto Components industry with market caps ranging from ₹167b to ₹535b, we found that the median CEO total compensation was ₹62m. So it looks like ZF Commercial Vehicle Control Systems India compensates Periakaruppa Kaniappan in line with the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹25m | ₹24m | 41% |

| Other | ₹37m | ₹35m | 59% |

| Total Compensation | ₹62m | ₹59m | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. ZF Commercial Vehicle Control Systems India sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at ZF Commercial Vehicle Control Systems India Limited's Growth Numbers

ZF Commercial Vehicle Control Systems India Limited has seen its earnings per share (EPS) increase by 58% a year over the past three years. Its revenue is up 11% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has ZF Commercial Vehicle Control Systems India Limited Been A Good Investment?

We think that the total shareholder return of 115%, over three years, would leave most ZF Commercial Vehicle Control Systems India Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for ZF Commercial Vehicle Control Systems India that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if ZF Commercial Vehicle Control Systems India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ZFCVINDIA

ZF Commercial Vehicle Control Systems India

Engages in supplying systems for automotive and industrial technology in India and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026