- India

- /

- Auto Components

- /

- NSEI:URAVIDEF

The five-year decline in earnings might be taking its toll on Uravi T & Wedge Lamps (NSE:URAVI) shareholders as stock falls 11% over the past week

While Uravi T & Wedge Lamps Limited (NSE:URAVI) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 28% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been spectacular. To be precise, the stock price is 662% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price. It really delights us to see such great share price performance for investors.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Uravi T & Wedge Lamps

While Uravi T & Wedge Lamps made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Uravi T & Wedge Lamps can boast revenue growth at a rate of 3.4% per year. That's not a very high growth rate considering the bottom line. Therefore, we're a little surprised to see the share price gain has been so strong, at 50% per year, compound, over the period. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

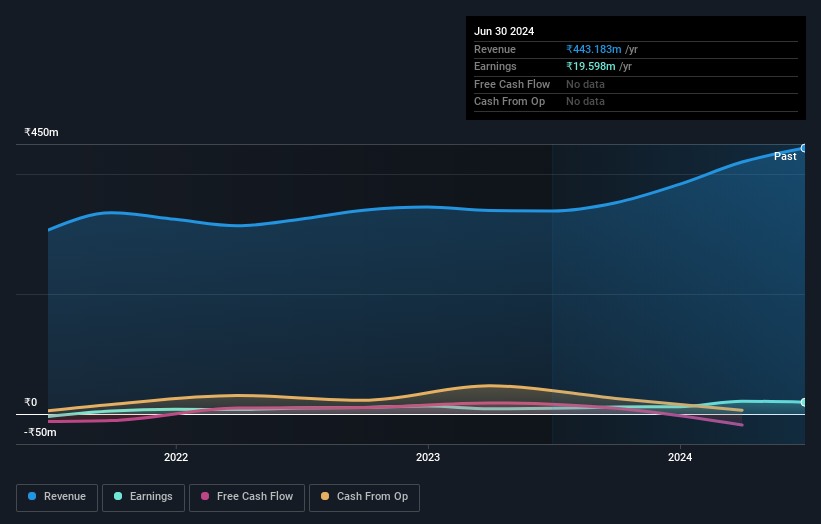

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Uravi T & Wedge Lamps shareholders have received a total shareholder return of 60% over one year. That gain is better than the annual TSR over five years, which is 50%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Uravi T & Wedge Lamps (2 are a bit concerning!) that you should be aware of before investing here.

Of course Uravi T & Wedge Lamps may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:URAVIDEF

Uravi Defence and Technology

Manufactures and sells wedge and various types of lamps for automobiles in India.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives