- India

- /

- Auto Components

- /

- NSEI:UNOMINDA

With EPS Growth And More, Uno Minda (NSE:UNOMINDA) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Uno Minda (NSE:UNOMINDA). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Uno Minda

Uno Minda's Improving Profits

Uno Minda has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Uno Minda's EPS soared from ₹8.43 to ₹11.99, over the last year. That's a fantastic gain of 42%.

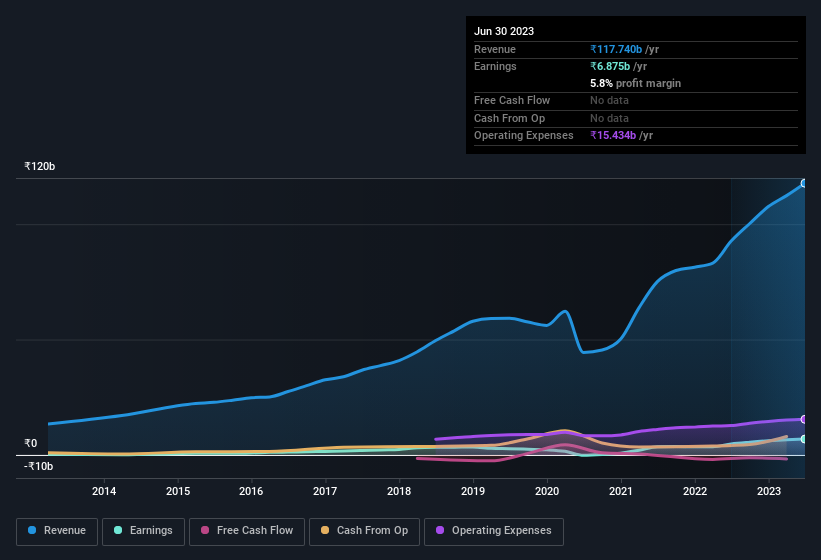

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Uno Minda achieved similar EBIT margins to last year, revenue grew by a solid 27% to ₹118b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Uno Minda's forecast profits?

Are Uno Minda Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Uno Minda will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 39% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. That means they have plenty of their own capital riding on the performance of the business!

Does Uno Minda Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Uno Minda's strong EPS growth. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Uno Minda , and understanding it should be part of your investment process.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:UNOMINDA

Uno Minda

Manufactures and supplies auto components and systems in India and internationally.

Flawless balance sheet with high growth potential.