- India

- /

- Auto Components

- /

- NSEI:SUPRAJIT

Suprajit Engineering Limited's (NSE:SUPRAJIT) CEO Compensation Looks Acceptable To Us And Here's Why

CEO Mohan Nagamangala has done a decent job of delivering relatively good performance at Suprajit Engineering Limited (NSE:SUPRAJIT) recently. As shareholders go into the upcoming AGM on 26 September 2022, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

See our latest analysis for Suprajit Engineering

Comparing Suprajit Engineering Limited's CEO Compensation With The Industry

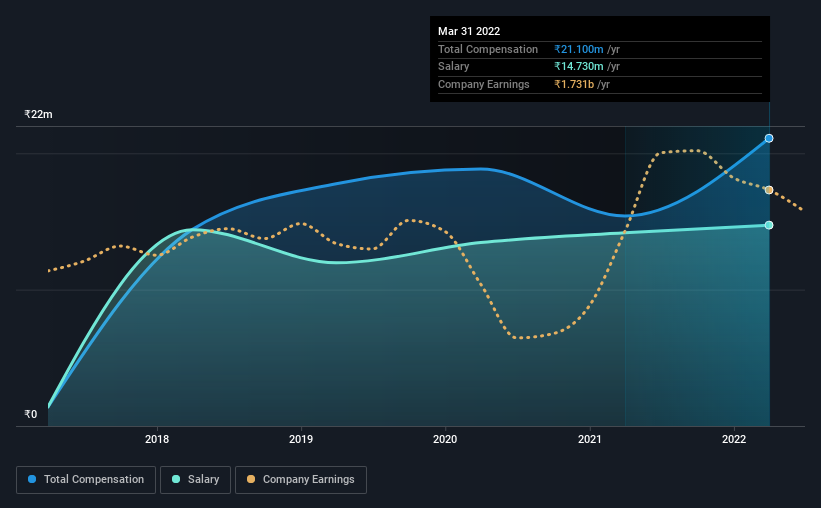

At the time of writing, our data shows that Suprajit Engineering Limited has a market capitalization of ₹46b, and reported total annual CEO compensation of ₹21m for the year to March 2022. Notably, that's an increase of 37% over the year before. We note that the salary portion, which stands at ₹14.7m constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the same industry with market caps ranging from ₹16b to ₹64b, we found that the median CEO total compensation was ₹27m. This suggests that Suprajit Engineering remunerates its CEO largely in line with the industry average. Moreover, Mohan Nagamangala also holds ₹2.9m worth of Suprajit Engineering stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹15m | ₹14m | 70% |

| Other | ₹6.4m | ₹1.2m | 30% |

| Total Compensation | ₹21m | ₹15m | 100% |

Speaking on an industry level, nearly 79% of total compensation represents salary, while the remainder of 21% is other remuneration. Suprajit Engineering pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Suprajit Engineering Limited's Growth Numbers

Over the past three years, Suprajit Engineering Limited has seen its earnings per share (EPS) grow by 7.0% per year. Its revenue is up 16% over the last year.

We would argue that the modest growth in revenue is a notable positive. And the improvement in EPSis modest but respectable. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Suprajit Engineering Limited Been A Good Investment?

Boasting a total shareholder return of 88% over three years, Suprajit Engineering Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Suprajit Engineering that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SUPRAJIT

Suprajit Engineering

Manufactures and sells automotive cables, halogen lamps, speedometers, and other automotive components in India, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)