- India

- /

- Capital Markets

- /

- NSEI:ANANDRATHI

Undiscovered Gems in India to Watch This September 2024

Reviewed by Simply Wall St

The Indian market has been flat over the last week but has risen 44% in the past 12 months, with earnings forecast to grow by 17% annually. In this dynamic environment, identifying stocks with strong growth potential and solid fundamentals can be key to capitalizing on future opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Goldiam International | 0.74% | 10.79% | 15.85% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| TCPL Packaging | 95.84% | 15.51% | 31.89% | ★★★★★☆ |

| Master Trust | 37.05% | 27.57% | 41.99% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Share India Securities | 24.23% | 37.66% | 48.98% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Anand Rathi Wealth (NSEI:ANANDRATHI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anand Rathi Wealth Limited offers financial and insurance services in India and has a market cap of ₹160.74 billion.

Operations: Anand Rathi Wealth Limited generates revenue primarily from the sale and distribution of financial products, amounting to ₹8.19 billion.

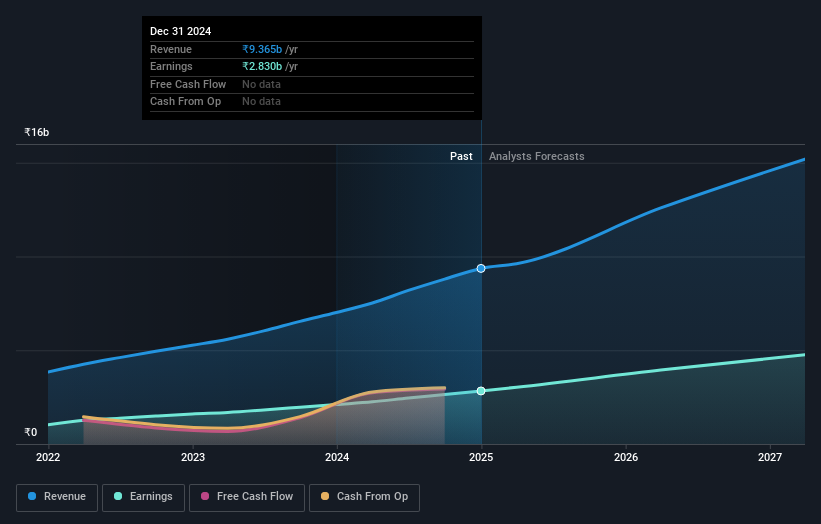

Anand Rathi Wealth has seen notable growth, with earnings increasing 31% annually over the past five years. Despite a debt-to-equity ratio of 7.8%, the company holds more cash than total debt, ensuring financial stability. Recent results indicate strong performance in Q1 2024, with net income rising to ₹732.39 million from ₹530.61 million a year ago and diluted EPS at ₹17.54 compared to ₹12.71 last year. The company also repurchased 370,000 shares for INR1,646 million this year, reflecting confidence in its future prospects.

- Unlock comprehensive insights into our analysis of Anand Rathi Wealth stock in this health report.

Explore historical data to track Anand Rathi Wealth's performance over time in our Past section.

Jai Balaji Industries (NSEI:JAIBALAJI)

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Balaji Industries Limited manufactures and markets iron and steel products primarily in India with a market cap of ₹164.28 billion.

Operations: The company's primary revenue stream is from the iron and steel segment, generating ₹66.50 billion.

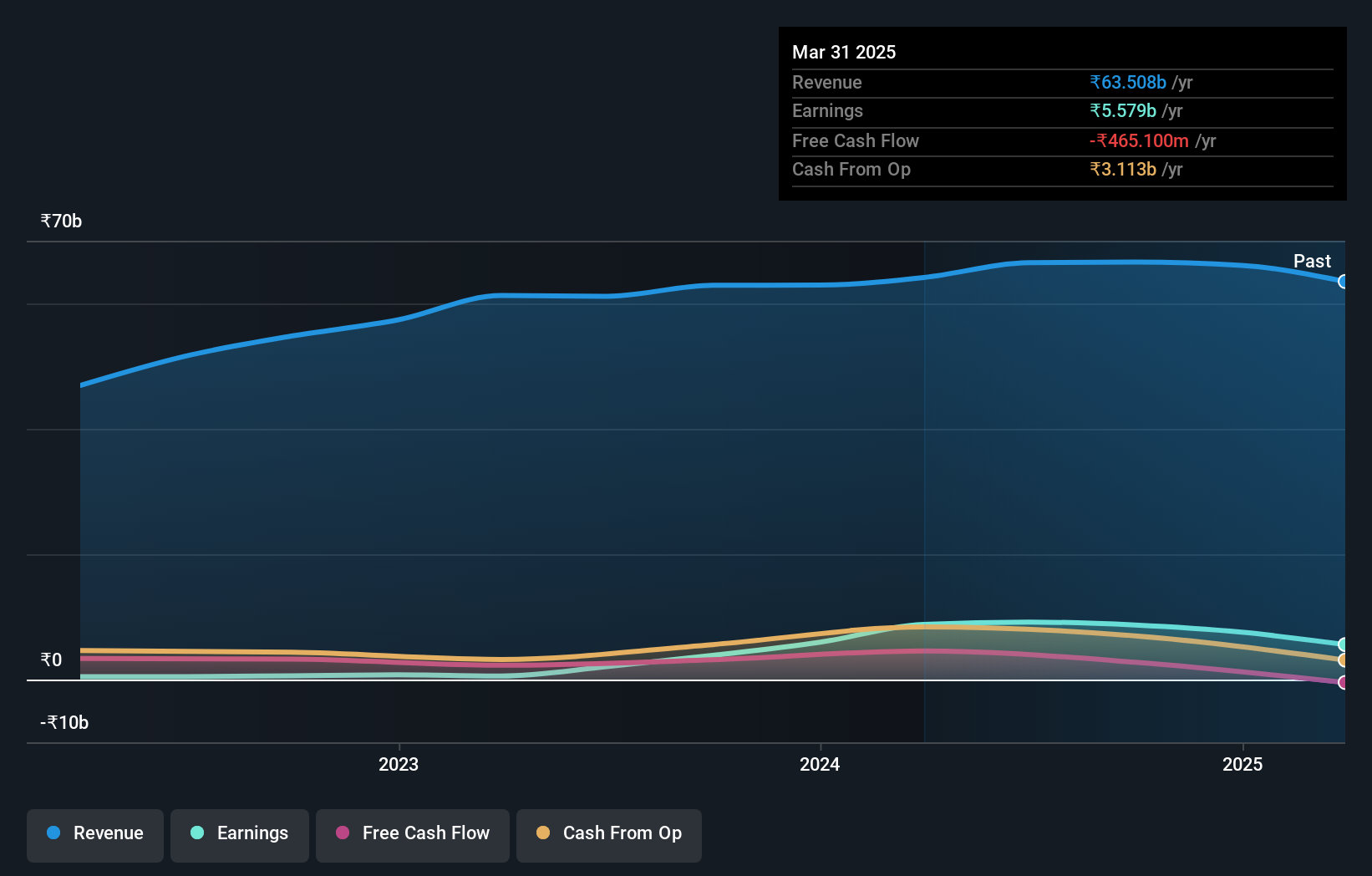

Earnings for Jai Balaji Industries surged by 344.7% in the past year, outpacing the Metals and Mining sector's 17.2%. With a net debt to equity ratio of 25.4%, its financial health seems satisfactory. Recent earnings reported INR 17,278 million in revenue and INR 2,088 million in net income for Q1 FY2025, reflecting strong performance with basic EPS at INR 12.1. The company’s EBIT covers interest payments by a factor of 13.9x, indicating robust profitability and high-quality earnings.

Sundaram Finance Holdings (NSEI:SUNDARMHLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sundaram Finance Holdings Limited engages in investments, business processing, and support services across India, Australia, and the United Kingdom with a market cap of ₹94.62 billion.

Operations: Sundaram Finance Holdings Limited generates revenue primarily from investments (₹2.51 billion), domestic shared services (₹105.51 million), and overseas shared services (₹489.78 million). The company's net profit margin is 23.45%.

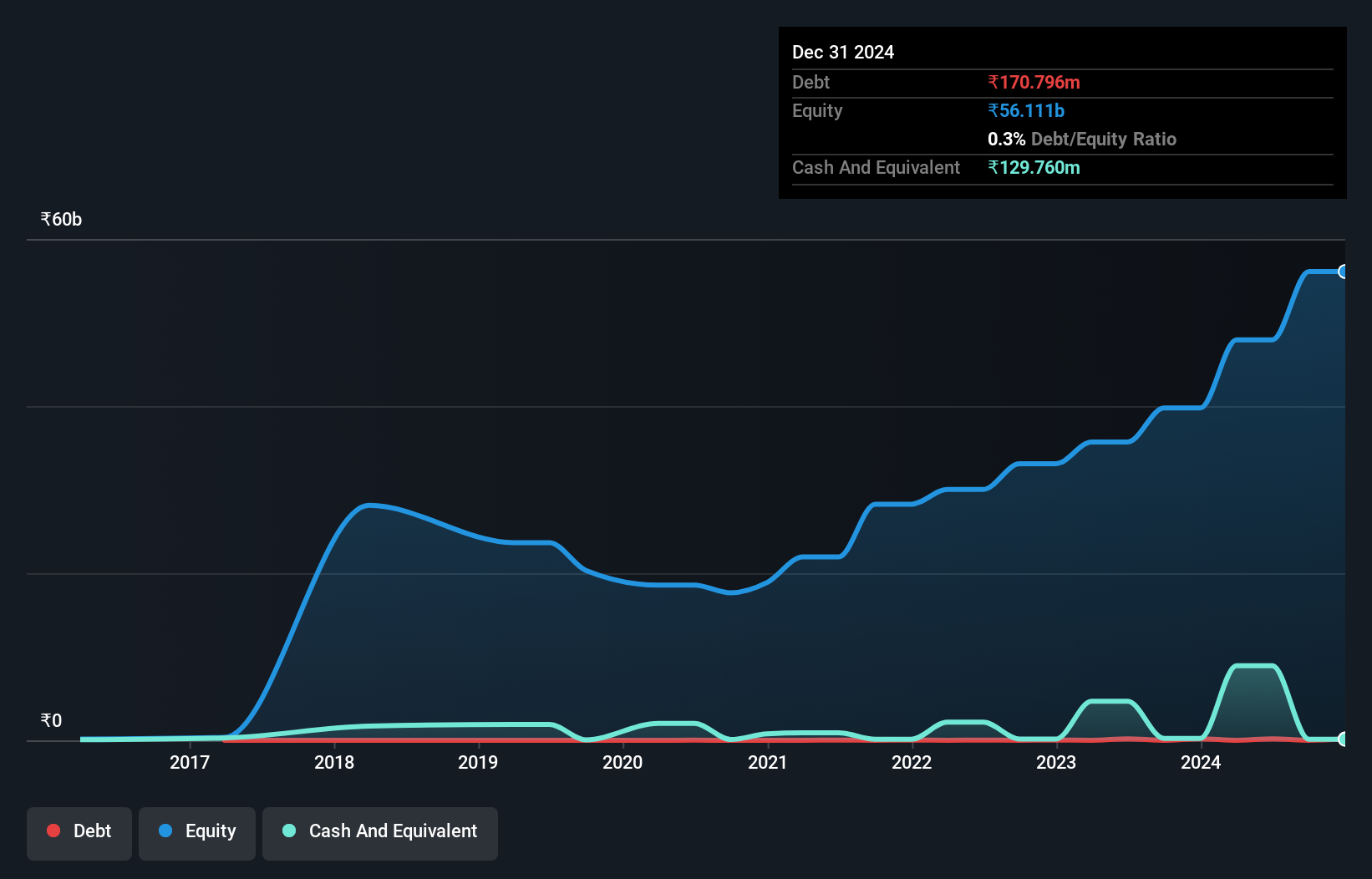

Sundaram Finance Holdings has demonstrated impressive earnings growth of 114.5% over the past year, significantly outpacing the Auto Components industry’s 20.1%. The company reported a net income of INR 1.10 billion for Q1 2024, up from INR 706.72 million a year ago, with basic earnings per share rising to INR 4.97 from INR 3.18 last year. With a debt-to-equity ratio increasing to just 0.4% over five years and EBIT covering interest payments by an astounding 265 times, financial stability seems well in hand.

- Click here and access our complete health analysis report to understand the dynamics of Sundaram Finance Holdings.

Assess Sundaram Finance Holdings' past performance with our detailed historical performance reports.

Summing It All Up

- Unlock our comprehensive list of 471 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ANANDRATHI

Anand Rathi Wealth

Provides financial advisory, brokerage, and consultancy services in India.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives