- India

- /

- Auto Components

- /

- NSEI:SUBROS

Why We Think Shareholders May Be Considering Bumping Up Subros Limited's (NSE:SUBROS) CEO Compensation

Key Insights

- Subros will host its Annual General Meeting on 18th of September

- Total pay for CEO Parmod Duggal includes ₹12.7m salary

- Total compensation is 73% below industry average

- Subros' total shareholder return over the past three years was 140% while its EPS grew by 17% over the past three years

The solid performance at Subros Limited (NSE:SUBROS) has been impressive and shareholders will probably be pleased to know that CEO Parmod Duggal has delivered. This would be kept in mind at the upcoming AGM on 18th of September which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

See our latest analysis for Subros

How Does Total Compensation For Parmod Duggal Compare With Other Companies In The Industry?

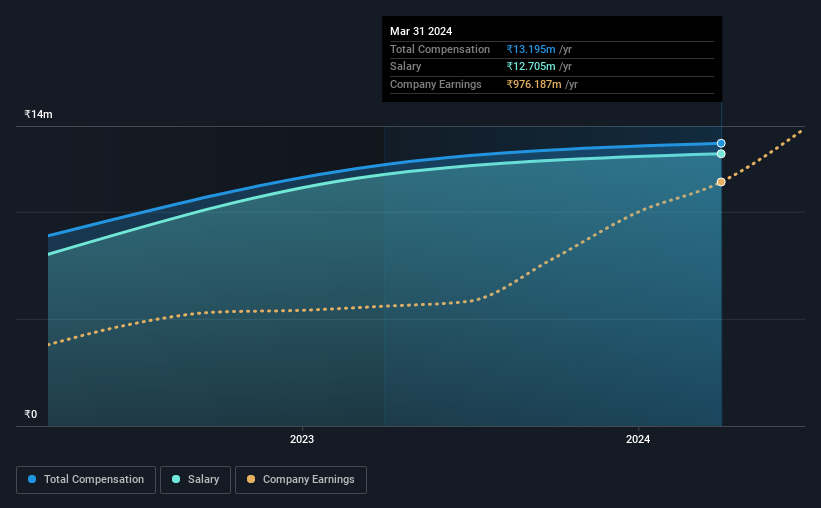

According to our data, Subros Limited has a market capitalization of ₹51b, and paid its CEO total annual compensation worth ₹13m over the year to March 2024. Notably, that's an increase of 8.2% over the year before. Notably, the salary which is ₹12.7m, represents most of the total compensation being paid.

On examining similar-sized companies in the Indian Auto Components industry with market capitalizations between ₹34b and ₹134b, we discovered that the median CEO total compensation of that group was ₹48m. In other words, Subros pays its CEO lower than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹13m | ₹12m | 96% |

| Other | ₹490k | ₹454k | 4% |

| Total Compensation | ₹13m | ₹12m | 100% |

On an industry level, around 76% of total compensation represents salary and 24% is other remuneration. Subros pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Subros Limited's Growth

Subros Limited has seen its earnings per share (EPS) increase by 17% a year over the past three years. It achieved revenue growth of 14% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Subros Limited Been A Good Investment?

We think that the total shareholder return of 140%, over three years, would leave most Subros Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Parmod receives almost all of their compensation through a salary. Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Subros that you should be aware of before investing.

Switching gears from Subros, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SUBROS

Subros

Engages in the manufacture and sale of thermal products for automotive applications in India.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)